Financial statements discussion and analysis

Public Accounts of Canada 2023 Volume I—Top of the page Navigation

- Previous page: Section 1: Financial statements discussion and analysis

- Section 1: Table of contents: Section 1: Financial statements discussion and analysis

- Next page: Ten-year comparative financial information

Introduction

The Public Accounts of Canada is a major accountability report of the Government of Canada. This section, together with the other sections in this volume and in Volumes II and III of the Public Accounts of Canada, provides detailed supplementary information in respect of matters reported in the audited consolidated financial statements in Section 2 of this volume. Supplementary discussion and analysis of the financial results can be found in the Annual Financial Report of the Government of Canada—Fiscal Year 2022–2023, available on the Department of Finance Canada's website.

The consolidated financial statements and financial statements discussion and analysis have been prepared under the joint direction of the Minister of Finance, the President of the Treasury Board, and the Receiver General for Canada. Responsibility for the integrity and objectivity of the consolidated financial statements and financial statements discussion and analysis rests with the government. A glossary of terms used in this financial statements discussion and analysis is provided at the end of this section.

2023 financial highlights

- The government posted an annual operating deficit of $35.3 billion for the fiscal year ended March 31, 2023, compared to a deficit of $90.3 billion in the previous fiscal year. The year-over-year improvement in the budgetary balance reflects the strong recovery of the Canadian economy from the effects of the pandemic along with the wind-down of temporary COVID-19 support measures.

- The annual operating deficit before net actuarial losses stood at $25.7 billion in 2023, compared to $80.1 billion in 2022. The annual operating deficit before net actuarial losses is intended to supplement the traditional budgetary balance and improve the transparency of the government's financial reporting by isolating the impact of the recognition of net actuarial losses arising from the government's public sector pensions and other employee and veteran future benefits.

- Compared to projections in Budget 2023, the annual operating deficit was $7.7 billion lower than the $43.0-billion deficit projected, mainly reflecting higher-than-expected tax revenues, partially offset by higher-than-expected program expenses and public debt charges. The annual operating deficit before net actuarial losses was $7.5 billion lower than projected.

- Revenues increased by $34.5 billion, or 8.4%, from 2022, reflecting a broad-based increase in revenue, supported by strong economic growth, tight labour markets, and resilient consumer spending.

- Program expenses excluding net actuarial losses decreased by $30.4 billion, or 6.5%, from 2022, largely reflecting lower transfers to individuals and businesses due to expiring temporary COVID-19 measures.

- Net actuarial losses, which reflect changes in the value of the government's obligations and assets for public sector pensions and other employee and veteran future benefits recorded in previous fiscal years, decreased $0.6 billion, or 5.5%, largely reflecting the end of the amortization period for certain prior years' net actuarial losses in 2022.

- Public debt charges were up $10.5 billion, or 42.7%, largely reflecting higher interest rates on the stock of interest-bearing debt.

- In 2023, the government recorded expenses totaling approximately $26 billion related to Indigenous claims, in advancing its commitment to resolve past injustices and renew its relationship with Indigenous Peoples. Absent these expenses, the 2023 budgetary deficit would have been roughly $9 billion, or 0.3% of gross domestic product (GDP).

- The accumulated deficit (the difference between total liabilities and total assets), or federal debt, stood at $1,173.0 billion at March 31, 2023. The accumulated deficit-to-GDP ratio was 42.2%, down from 45.4% in the previous year. As noted in Budget 2023, the government remains committed to its fiscal anchor of reducing the federal debt as a share of the economy over the medium term.

Discussion and analysis

Economic contextLink to Table note 1

The Canadian economy continued its rapid recovery from the pandemic and was more resilient in 2022 than had been expected in the wake of rapid increases in interest rates. Canada saw the strongest growth in the G7 over the course of 2022. Canadian real GDP grew by 3.4% in 2022 and was 3.7% above its pre-pandemic level in the first quarter of 2023 – the fastest recovery of the last four recessions.

Solid economic growth helped an additional 750,000 Canadians find jobs between 2021 and 2022, pulling the unemployment rate to a 50 year low. More people aged 15 to 64 years are engaged in the labour market than ever before, with meaningful increases for historically under-represented groups, including women, newcomers, and young Canadians. The labour force participation rate among women aged 25 to 54 years reached record highs.

Supply chain disruptions and surging commodity prices following Russia's invasion of Ukraine exacerbated economy-wide price pressures, with consumer price inflation peaking at 8.1% in June 2022. Since then, Canada has managed to make significant progress in reducing inflation, reaching 3.2% in July 2023.

Elevated consumer price inflation combined with high commodity prices and a resilient economy led to another year of double-digit growth in nominal GDP, the broadest measure of the tax base, at 10.9% in 2022 after growing 13.6% in 2021.

Faced with inflationary pressures and excess demand in the economy, the Bank of Canada raised its policy rate by 425 basis points to 4.5% between March 2022 and the end of fiscal year 2023 – the highest rate since 2007 and above its estimated "neutral range" of 2–3%.

Looking ahead, the lagged impacts of monetary policy tightening are expected to gradually build and broaden, slowing overall economic activity. Over time, slower growth is expected to help bring demand into balance with supply, gradually easing labour market tightness and slowing underlying inflation. Economic growth is expected to pick up over the course of 2024 as the effect of higher interest rates in Canada and globally dissipates.

The government regularly surveys private sector economists on their views on the economy to assess and manage risk. The survey of private sector economists has been used as the basis for economic and fiscal planning since 1994 and introduces an element of independence into the government's forecasts.

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Real GDP growth | ||||

| Budget 2022 | 5.0 | 4.1 | 3.1 | 2.0 |

| Budget 2023 | 5.0 | 3.4 | 0.3 | 1.5 |

| Actual | 5.0 | 3.4 | – | – |

| Nominal GDP growth | ||||

| Budget 2022 | 13.6 | 8.1 | 4.8 | 3.9 |

| Budget 2023 | 13.6 | 10.9 | 0.8 | 3.6 |

| Actual | 13.6 | 10.9 | – | – |

| 3-month Treasury bill rate | ||||

| Budget 2022 | 0.1 | 0.8 | 1.7 | 2.0 |

| Budget 2023 | 0.1 | 2.4 | 4.4 | 3.3 |

| Actual | 0.1 | 2.4 | – | – |

| 10-year government bond rate | ||||

| Budget 2022 | 1.4 | 2.0 | 2.4 | 2.6 |

| Budget 2023 | 1.4 | 2.8 | 3.0 | 2.9 |

| Actual | 1.4 | 2.8 | – | – |

| Unemployment rate | ||||

| Budget 2022 | 7.5 | 5.8 | 5.5 | 5.5 |

| Budget 2023 | 7.5 | 5.3 | 5.8 | 6.2 |

| Actual | 7.5 | 5.3 | – | – |

| Consumer price index inflation | ||||

| Budget 2022 | 3.4 | 3.9 | 2.4 | 2.2 |

| Budget 2023 | 3.4 | 6.8 | 3.5 | 2.1 |

| Actual | 3.4 | 6.8 | – | – |

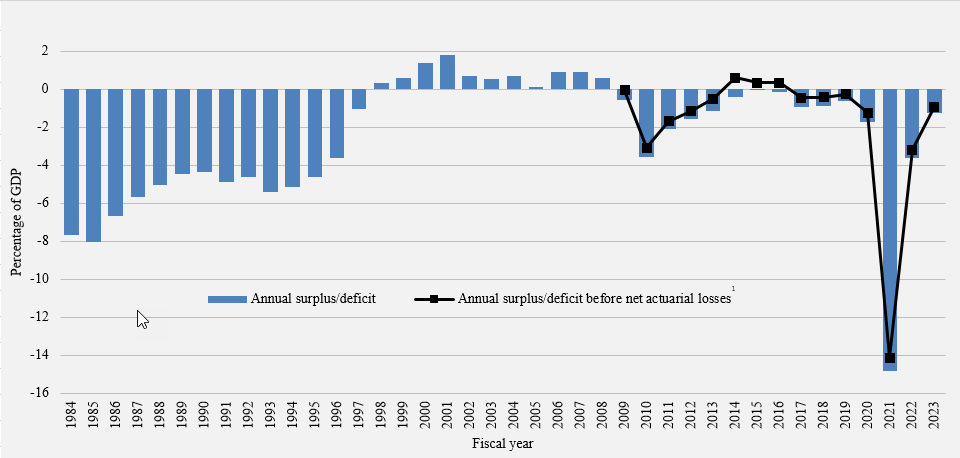

The budgetary balance

The budgetary balance, or annual operating surplus/deficit, is the difference between the government's revenues and total expenses over a fiscal year. It is one of the key measures of the government's annual financial performance. The government posted an annual operating deficit of $35.3 billion in 2023, compared to a deficit of $90.3 billion in 2022.

The annual operating deficit before net actuarial losses represents the difference between the government's revenues and expenses excluding net actuarial losses. By excluding the impact of changes in the estimated value of the government's obligations and assets for public sector pensions and other employee and veteran future benefits recorded in previous fiscal years, this measure is intended to present a clearer picture of the results of government operations during the current fiscal year. The annual operating deficit before net actuarial losses stood at $25.7 billion in 2023, compared to $80.1 billion in 2022.

The following graph shows the government's budgetary balance since 1984, as well as the budgetary balance before net actuarial losses since 2009. To enhance the comparability of results over time and across jurisdictions, the budgetary balance and its components are presented as a percentage of GDP. In 2023, the annual operating deficit was 1.3% of GDP, compared to a deficit of 3.6% of GDP a year earlier. The annual operating deficit before net actuarial losses was 0.9% of GDP, compared to a deficit of 3.2% of GDP a year earlier.

Annual operating surplus/deficit

Note 1: In 2018, the government implemented, on a retroactive basis, a change in its methodology for the determination of the discount rate for unfunded pension benefits. Fiscal results for 2009 to 2017 were restated to reflect this change. Restated data for years prior to 2009 is not available.

(percentage of GDP)

Image Description

| Fiscal year | Annual surplus/deficit | Annual surplus/deficit before net actuarial lossesLink to table note 1 |

|---|---|---|

| 1984 | (negative 7.7) | |

| 1985 | (negative 8.0) | |

| 1986 | (negative 6.7) | |

| 1987 | (negative 5.7) | |

| 1988 | (negative 5.1) | |

| 1989 | (negative 4.5) | |

| 1990 | (negative 4.3) | |

| 1991 | (negative 4.9) | |

| 1992 | (negative 4.6) | |

| 1993 | (negative 5.4) | |

| 1994 | (negative 5.2) | |

| 1995 | (negative 4.6) | |

| 1996 | (negative 3.6) | |

| 1997 | (negative 1.0) | |

| 1998 | 0.3 | |

| 1999 | 0.6 | |

| 2000 | 1.4 | |

| 2001 | 1.8 | |

| 2002 | 0.7 | |

| 2003 | 0.6 | |

| 2004 | 0.7 | |

| 2005 | 0.1 | |

| 2006 | 0.9 | |

| 2007 | 0.9 | |

| 2008 | 0.6 | |

| 2009 | (negative 0.6) | 0.0 |

| 2010 | (negative 3.6) | (negative 3.1) |

| 2011 | (negative 2.1) | (negative 1.7) |

| 2012 | (negative 1.6) | (negative 1.1) |

| 2013 | (negative 1.2) | (negative 0.5) |

| 2014 | (negative 0.4) | 0.6 |

| 2015 | 0.0 | 0.4 |

| 2016 | (negative 0.1) | 0.4 |

| 2017 | (negative 0.9) | (negative 0.4) |

| 2018 | (negative 0.9) | (negative 0.4) |

| 2019 | (negative 0.6) | (negative 0.3) |

| 2020 | (negative 1.7) | (negative 1.2) |

| 2021 | (negative 14.8) | (negative 14.1) |

| 2022 | (negative 3.6) | (negative 3.2) |

| 2023 | (negative 1.27) | (negative 0.9) |

Revenues were up $34.5 billion, or 8.4%, from the prior year, reflecting a broad-based increase in revenue, supported by strong labour markets and robust profits, notably in the resource sector.

Total expenses were down $20.5 billion, or 4.1%, from the prior year. Program expenses excluding net actuarial losses decreased by $30.4 billion, or 6.5%, primarily reflecting lower transfers to individuals and businesses due to expiring temporary COVID-19 measures.

Net actuarial losses decreased by $0.6 billion, or 5.5%, from the prior year, largely reflecting the end of the amortization period for certain prior years' net actuarial losses in 2022.

Public debt charges increased by $10.5 billion, or 42.7%, from the prior year, largely reflecting higher interest rates on the government's market debt and pension and benefit obligations.

Indigenous Claims

The government is committed to advancing reconciliation, supporting Indigenous Peoples' right to self-determination, and addressing historical wrongs and systemic racism. Acknowledging and resolving past injustices through the resolution of Indigenous claims is an important part of renewing the relationship between the Government of Canada and Indigenous Peoples.

Indigenous claims can be grouped into four main categories, as follows:

- Comprehensive land claims, which arise in areas of the country where Aboriginal rights and title have not been resolved by treaty or by other legal means. There are currently 83 comprehensive land claims under negotiation, accepted for negotiation or under review.

- Specific claims, which deal with the past grievances of First Nations related to Canada's obligations under historic treaties or the way it managed First Nations' funds or other assets. There are currently 698 specific claims under negotiation, accepted for negotiation or under review.

- General litigation claims being pursued through the courts, which include compensation related to the First Nations Child and Family Services program, Jordan's Principle, and residential schools.

- Special claims, which represent claims that are not being pursued through the courts and that do not fit within the parameters of existing policies for Comprehensive Land Claims or Specific Claims.

In 2023, the government recorded expenses totaling approximately $26 billion related to Indigenous claims. Absent these expenses, the 2023 budgetary deficit would have been roughly $9 billion. This reflects the government's efforts to work with Indigenous partners to collaboratively address past injustices and to accelerate the resolution of litigation and the implementation of negotiated settlements to support reconciliation in Canada.

| 2023 | 2022 RestatedLink to table note 1 |

|

|---|---|---|

| Consolidated Statement of Operations | ||

| Revenues | 447,815 | 413,277 |

| Expenses | ||

| Program expenses, excluding net actuarial losses | 438,555 | 468,919 |

| Public debt charges | 34,955 | 24,487 |

| Total expenses, excluding net actuarial losses | 473,510 | 493,406 |

| Annual operating deficit before net actuarial losses | (negative 25,695) | (negative 80,129) |

| Net actuarial losses | (negative 9,627) | (negative 10,186) |

| Annual operating deficit | (negative 35,322) | (negative 90,315) |

| Percentage of GDP | (1.3%) | (3.6%) |

| Consolidated Statement of Financial Position | ||

| Liabilities | ||

| Accounts payable and accrued liabilities | 259,440 | 262,529 |

| Interest-bearing debt | 1,616,753 | 1,585,035 |

| Foreign exchange accounts liabilities | 44,151 | 42,252 |

| Derivatives | 4,689 | 2,471 |

| Total liabilities | 1,925,033 | 1,892,287 |

| Financial assets | 642,276 | 647,543 |

| Net debt | (negative 1,282,757) | (negative 1,244,744) |

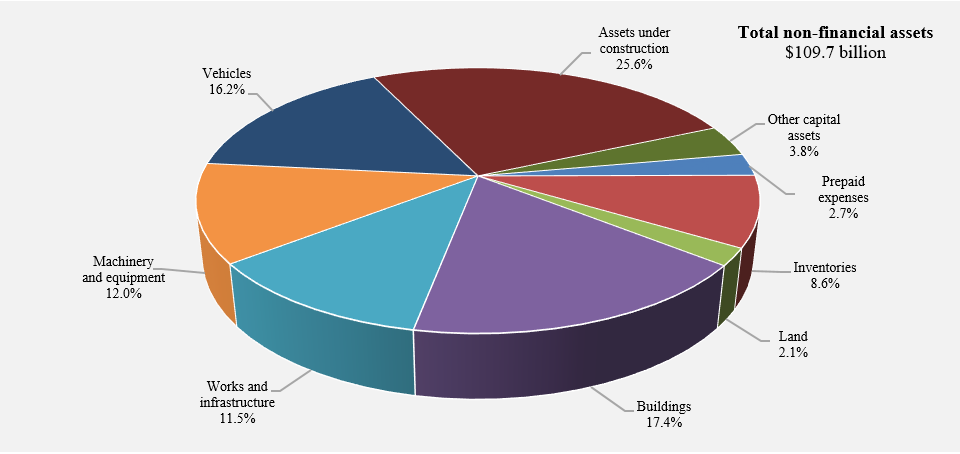

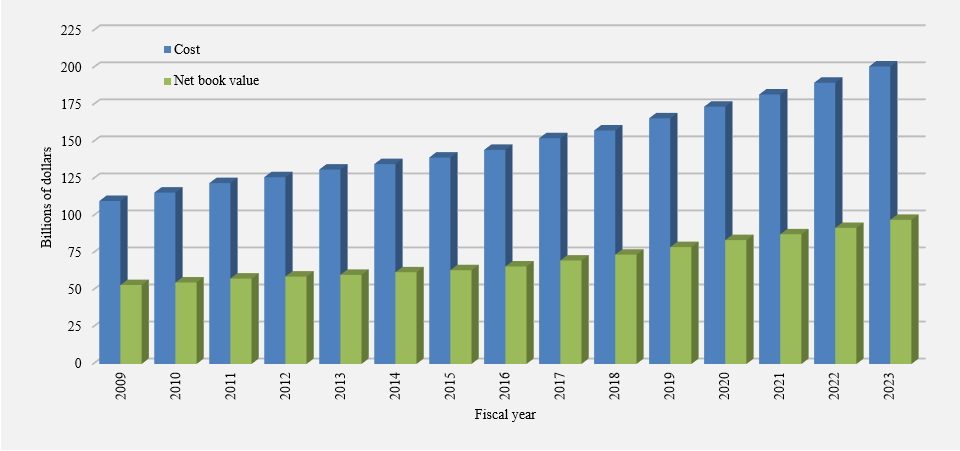

| Non-financial assets | 109,744 | 104,769 |

| Accumulated deficit | (negative 1,173,013) | (negative 1,139,975) |

| Percentage of GDP | 42.2% | 45.4% |

Annual operating deficit before net actuarial losses

Actuarial losses and gains arise from the annual remeasurement of the government's existing obligations for public sector pensions and other employee and veteran future benefits, as well as differences between actual and expected returns on pension assets. The measurement of these obligations and expected returns on pension assets involves the extensive use of estimates and assumptions about future events and circumstances, such as discount rates, future inflation, returns on investments, general wage increases, workforce composition, retirement rates, and mortality rates. In particular, the unfunded obligations are sensitive to changes in both short- and long-term interest rates, which are used to estimate the value of expected future benefit payments in today's dollars. Unfunded benefit obligations are discounted based on the spot rates of Government of Canada bonds at fiscal year-end (March 31), which can fluctuate significantly from one year to the next, resulting in actuarial gains and losses that flow through the budgetary balance.

While these adjustments and revaluations are an important part of providing an accurate picture of the government's Consolidated Statement of Financial Position at a given time, they can also result in large swings in the budgetary balance, which may impair the usefulness and understandability of the government's consolidated financial statements and fiscal projections, including as a measurement of the short-term impact of government spending and taxation choices on the economy.

The annual operating deficit before net actuarial losses isolates the impact of adjustments and remeasurements of previously recorded public sector pensions and other employee and veteran future benefits and provides a clearer view of the government's planned and actual operating activities in an accounting period, with the aim of enhancing transparency and accountability.

Accounting changes in 2023

Starting in the fiscal year ending March 31, 2023, the government adopted new accounting standards issued by the Public Sector Accounting Board (PSAB) related to asset retirement obligations and financial instruments.

The asset retirement obligation standard requires public sector entities to recognize liabilities for legal obligations to incur costs associated with the retirement of controlled tangible capital assets arising on their acquisition, construction, or development or through their normal use, and to expense those costs systematically over the life of the respective assets. This includes activities such as decommissioning of nuclear reactors, removal of asbestos, and demilitarization or disarmament. The adoption of this standard has not had a material effect on the annual operating deficit for the current year. However, this accounting change has resulted in a net $5.5-billion increase in the opening balance of the accumulated deficit for 2023 to reflect the estimated value of the government's assets and liabilities associated with asset retirement obligations as of April 1, 2022. Comparative figures for 2022 have also been restated as part of the transition to this new standard. Asset retirement obligations are mostly based on long term estimates, and the government uses assumptions about the timing and cost of future retirement activities. These estimates may be refined over time as information regarding the eventual costs to be incurred becomes available.

The government also adopted new accounting standards that prescribe recognition, measurement, and disclosure requirements for financial instruments. Financial instruments include primary instruments (such as receivables, payables, debt, and equity instruments) and derivative financial instruments (such as forward contracts and cross currency swaps). Under the new PSAB guidance, derivatives, which were previously recorded at historical cost, are recognized at fair value. Changes in the fair value of derivatives are not reflected in the budgetary balance but are instead charged directly to the accumulated deficit as accumulated remeasurement gains and losses. Remeasurement gains and losses, along with other comprehensive income reported by enterprise Crown corporations and other government business enterprises, are presented in a new financial statement, the Consolidated Statement of Remeasurement Gains and Losses, in Section 2 of this volume.

The financial instruments standard has been applied on a prospective basis. Accordingly, prior years' budgetary results have not been restated for this accounting change, but the opening balance of the accumulated deficit for 2023 has been increased by $2.6 billion to reflect derivative assets and liabilities at their fair values as of April 1, 2022, and to adjust the value of unmatured debt. In addition, certain prior years' asset and liability balances presented for comparative purposes have been reclassified to reflect the current year's presentation.

Further details regarding these changes can be found in Note 2 to the Consolidated Financial Statements in Section 2.

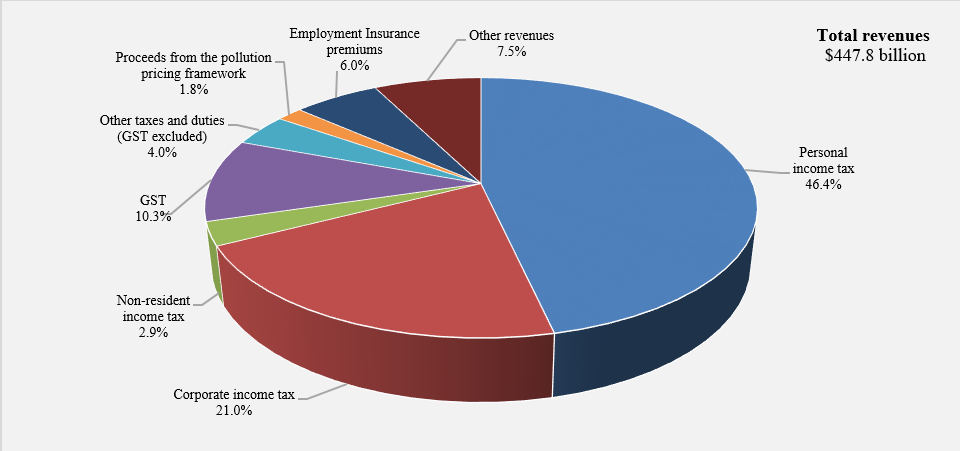

Revenues

Federal revenues can be broken down into five main categories: income tax revenues, other taxes and duties, Employment Insurance (EI) premium revenues, proceeds from the pollution pricing framework, and other revenues.

Within the income tax category, personal income tax revenues are the largest source of federal revenues and accounted for 46.4% of total revenues in 2023 (down from 48.0% in 2022). Corporate income tax revenues are the second largest source of revenues and accounted for 21.0% of total revenues in 2023 (up from 19.1% in 2022). Non-resident income tax revenues are a comparatively smaller source of revenues, accounting for only 2.9% of total revenues in 2023 (up from 2.6% in 2022).

Other taxes and duties consist of revenues from the Goods and Services Tax (GST), energy taxes, customs import duties, and other excise taxes and duties. The largest component of this category—GST revenues—accounted for 10.3% of all federal revenues in 2023 (down from 11.2% in 2022). The share of the remaining components of other taxes and duties stood at 4.0% of total federal revenues (from 4.0% in 2022).

EI premium revenues accounted for 6.0% of total federal revenues in 2023 (up from 5.8% in 2022).

Proceeds from the federal carbon pollution pricing framework accounted for 1.8% of total federal revenues in 2023 (up from 1.5% in 2022). All direct proceeds from the federal carbon pollution pricing system are returned to the jurisdictions where they were collected, as required under the Greenhouse Gas Pollution Pricing Act.

Other revenues are made up of three broad components: net income from enterprise Crown corporations and other government business enterprises; other program revenues from returns on investments, proceeds from the sales of goods and services, and other miscellaneous revenues; and foreign exchange revenues. Other revenues accounted for 7.5% of total federal revenues in 2023 (down from 7.8% in 2022).

Composition of revenues for 2023

Note: Numbers may not add to 100% due to rounding.

Image Description

| Revenues | Percentage |

|---|---|

| Personal income tax | 46.4% |

| Corporate income tax | 21% |

| Non-resident income tax | 2.9% |

| GST | 10.3% |

| Other taxes and duties (GST excluded) | 4% |

| Proceeds from the pollution pricing framework | 1.8% |

| Employment Insurance premiums | 6% |

| Other revenues | 7.5% |

Revenues compared to 2022

Total revenues amounted to $447.8 billion in 2023, up $34.5 billion, or 8.4%, from 2022. The following table compares revenues for 2023 to 2022.

| 2023 | 2022 | Change | ||

|---|---|---|---|---|

| $ | % | |||

| Income tax revenues | ||||

| Personal | 207,872 | 198,385 | 9,487 | 4.8 |

| Corporate | 93,945 | 78,815 | 15,130 | 19.2 |

| Non-resident | 13,187 | 10,789 | 2,398 | 22.2 |

| Total | 315,004 | 287,989 | 27,015 | 9.4 |

| Other taxes and duties | ||||

| Goods and services tax | 45,962 | 46,165 | (negative 203) | (negative 0.4) |

| Energy taxes | 5,657 | 5,355 | 302 | 5.6 |

| Customs import duties | 6,057 | 5,237 | 820 | 15.7 |

| Other excise taxes and duties | 6,548 | 5,923 | 625 | 10.6 |

| Total | 64,224 | 62,680 | 1,544 | 2.5 |

| Employment insurance premiums | 26,914 | 23,856 | 3,058 | 12.8 |

| Proceeds from the pollution pricing framework | 8,041 | 6,341 | 1,700 | 26.8 |

| Other revenues | 33,632 | 32,411 | 1,221 | 3.8 |

| Total revenues | 447,815 | 413,277 | 34,538 | 8.4 |

- Personal income tax revenues increased by $9.5 billion in 2023, or 4.8%, reflecting a solid labour market performance, with continuing strong labour force participation and employment, as well as robust investment income growth.

- Corporate income tax revenues increased by $15.1 billion, or 19.2%, reflecting strong growth in corporate profits, particularly in the resource sector.

- Non-resident income tax revenues are paid by non-residents on Canadian-sourced income. These revenues increased by $2.4 billion, or 22.2%, reflecting strong investment income gains.

- Other taxes and duties increased by $1.5 billion, or 2.5%. GST revenues decreased by $0.2 billion in 2023, or 0.4%, reflecting the additional GST credit and the Grocery Rebate introduced by the government and decelerating consumer spending growth. Energy taxes increased by $0.3 billion, or 5.6%, driven by an increase in motive fuel consumption. Customs import duties increased by $0.8 billion, or 15.7%, reflecting growth in imports as well as the expiry of the Certain Goods Remission Order, which waived customs and import duties on medical supplies, including personal protective equipment, from May 5, 2020, to May 6, 2022. Other excise taxes and duties were up $0.6 billion, or 10.6%, driven by a significant rebound in revenues from the Air Travellers Security Charge.

- EI premium revenues increased by $3.1 billion, or 12.8%, reflecting a higher premium rate and improving labour market conditions.

- Proceeds from the federal carbon pollution pricing framework increased by $1.7 billion, or 26.8%, reflecting a higher carbon pollution price of $50 per tonne in fiscal year 2023 versus $40 per tonne in the year prior.

- Other revenues increased by $1.2 billion, or 3.8%, reflecting higher interest revenue and revenue from the sales of goods and services, which were partially offset by lower profits reported by enterprise Crown corporations.

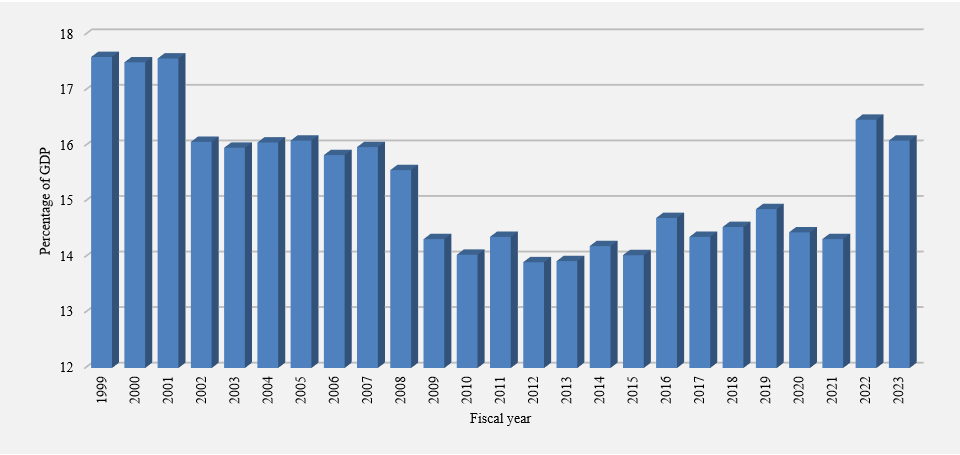

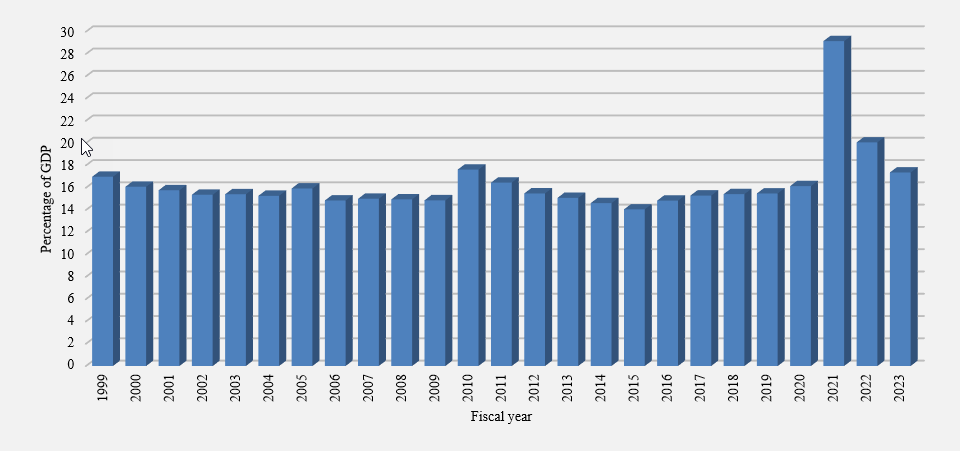

The revenue ratio—revenues as a percentage of GDP—compares the total of all federal revenues to the size of the economy. This ratio is influenced by changes in statutory tax rates and by economic developments. The ratio stood at 16.1% in 2023 (down from 16.5% in 2022), as lower revenues from enterprise Crown corporations (particularly the Bank of Canada) offset some of the strength in the personal and corporate income tax streams.

Revenue ratio

(revenues as a percentage of GDP)

Image Description

| Fiscal year | Percentage |

|---|---|

| 1999 | 17.6 |

| 2000 | 17.5 |

| 2001 | 17.6 |

| 2002 | 16.1 |

| 2003 | 16.0 |

| 2004 | 16.1 |

| 2005 | 16.1 |

| 2006 | 15.8 |

| 2007 | 16.0 |

| 2008 | 15.6 |

| 2009 | 14.3 |

| 2010 | 14.0 |

| 2011 | 14.4 |

| 2012 | 13.9 |

| 2013 | 13.9 |

| 2014 | 14.2 |

| 2015 | 14.0 |

| 2016 | 14.7 |

| 2017 | 14.4 |

| 2018 | 14.5 |

| 2019 | 14.9 |

| 2020 | 14.4 |

| 2021 | 14.3 |

| 2022 | 16.5 |

| 2023 | 16.1 |

Expenses

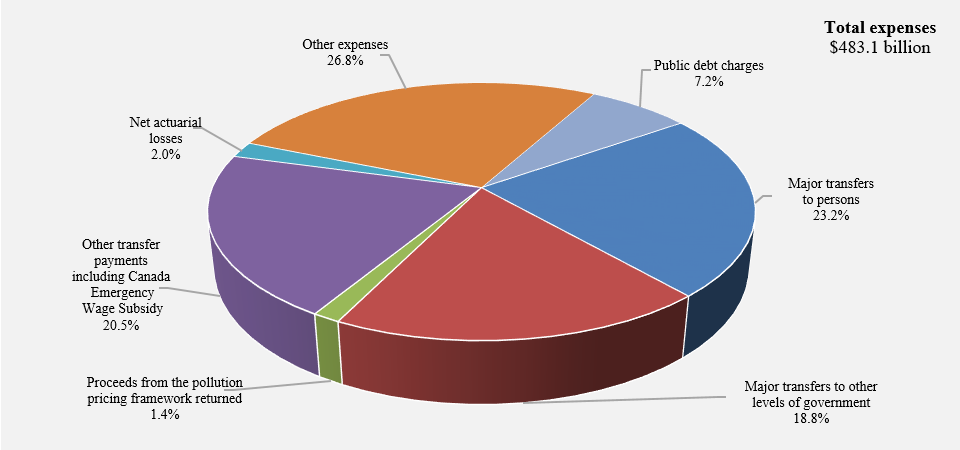

Federal expenses can be broken down into four main categories: transfer payments, which account for the majority of all federal spending, other expenses, public debt charges, and net actuarial losses.

Transfer payments are classified under five categories:

- Major transfers to persons made up 23.2% of total expenses (down from 28.1% in 2022). This category consists of elderly benefits, EI benefits and support measures, children''s benefits, and COVID-19 income support for workers (the Canada Emergency Response Benefit, or CERB, the Canada Recovery Benefit, the Canada Recovery Sickness Benefit, the Canada Recovery Caregiving Benefit, and the Canada Worker Lockdown Benefit) introduced under Canada''s COVID-19 Economic Response Plan. Of this, COVID-19 income support for workers accounted for a 0.7% decrease in total expenses in 2023 due to redeterminations of benefit overpayments, which are accounted for as a reduction in expenses (whereas it contributed 3.1% of total expenses in 2022).

- Major transfers to other levels of government—which include the Canada Health Transfer, the Canada Social Transfer, Canada-wide early learning and child care transfers, health agreements with provinces and territories, fiscal arrangements (Equalization, transfers to the territories, a number of smaller transfer programs and the Quebec Abatement), and the Canada Community-Building Fund (previously the Gas Tax Fund) transfers—made up 18.8% of total expenses in 2023 (up from 17.6% in 2022).

- Proceeds from the federal carbon pollution pricing framework returned made up 1.4% of expenses (up from 0.8% in 2022). These transfers consist of payments that return direct proceeds from the federal carbon pollution pricing system to the jurisdictions where they were collected, as required under the Greenhouse Gas Pollution Pricing Act. For more information on the return of proceeds, please consult the Greenhouse Gas Pollution Pricing Act Annual Report to Parliament.

- The Canada Emergency Wage Subsidy (CEWS), which provided payments to eligible employers as part of the COVID-19 Economic Response Plan, ended in 2022. Redeterminations of previous claims reduced total expenses by 0.1% in 2023 (compared to the program contributing 4.4% of total expenses in 2022).

- Other transfer payments, which include transfers to Indigenous peoples, assistance to farmers, students and businesses, support for research and development, and international assistance, made up 20.5% of expenses (up from 17.6% in 2022).

Other expenses, which represent the operating expenses of the government's 134 departments, agencies, and consolidated Crown corporations and other entities, accounted for 26.8% of total expenses in 2023 (up from 24.7% in 2022).

Public debt charges made up 7.2% of total expenses in 2023 (up from 4.9% in 2022).

Net actuarial losses made up the remaining 2.0% of total expenses in 2023 (unchanged from 2022).

Composition of expenses for 2023

Note: Numbers may not add to 100% due to rounding.

Image Description

| Expenses | Percentage |

|---|---|

| Major transfers to persons, including COVID-19 income support for workers | 23.2% |

| Major transfers to other levels of government | 18.8% |

| Proceeds from the pollution pricing framework returned | 1.4% |

| Other transfer payments and Canada emergency wage subsidy | 20.5% |

| Net actuarial losses | 2.0% |

| Other expenses | 26.8% |

| Public debt charges | 7.2% |

Expenses compared to 2022

Total expenses amounted to $483.1 billion in 2023, down $20.5 billion, or 4.1%, from 2022. The following table compares total expenses for 2023 to 2022.

| 2023 | 2022 RestatedLink to table note 1 |

Change | ||

|---|---|---|---|---|

| $ | % | |||

| Transfer payments | ||||

| Major transfers to persons | ||||

| Elderly benefits | 69,392 | 60,774 | 8,618 | 14.2 |

| Employment insurance and support measures | 21,836 | 38,923 | (negative 17,087) | (negative 43.9) |

| Children's benefits | 24,553 | 26,226 | (negative 1,673) | (negative 6.4) |

| COVID-19 income support for workers | (negative 3,544) | 15,582 | (negative 19,126) | (negative 122.7) |

| Total | 112,237 | 141,505 | (negative 29,268) | (negative 20.7) |

| Major transfers to other levels of government | ||||

| Federal transfer support for health and other social programs | 63,079 | 60,607 | 2,472 | 4.1 |

| Fiscal arrangements and other transfers | 27,705 | 27,779 | (negative 74) | (negative 0.3) |

| Total | 90,784 | 88,386 | 2,398 | 2.7 |

| Proceeds from the pollution pricing framework returned | 6,996 | 3,814 | 3,182 | 83.4 |

| Canada emergency wage subsidy | (negative 257) | 22,291 | (negative 22,548) | (negative 101.2) |

| Other transfer payments | 99,199 | 88,478 | 10,721 | 12.1 |

| Total transfer payments | 308,959 | 344,474 | (negative 35,515) | (negative 10.3) |

| Other expenses, excluding net actuarial losses | 129,596 | 124,445 | 5,151 | 4.1 |

| Total program expenses, excluding net actuarial losses | 438,555 | 468,919 | (negative 30,364) | (negative 6.5) |

| Public debt charges | 34,955 | 24,487 | 10,468 | 42.7 |

| Total expenses, excluding net actuarial losses | 473,510 | 493,406 | (negative 19,896) | (negative 4.0) |

| Net actuarial losses | 9,627 | 10,186 | (negative 559) | (negative 5.5) |

| Total expenses | 483,137 | 503,592 | (negative 20,455) | (negative 4.1) |

- Major transfers to persons decreased by $29.3 billion in 2023, largely due to the end of temporary COVID-19 measures. COVID-19 income support for workers decreased $19.1 billion, reflecting the wind-down of these programs, as well as the redetermination of benefits. EI benefits and support measures decreased by $17.1 billion, or 43.9%, largely reflecting the expiry of temporary measures to facilitate access to EI, and a lower unemployment rate. Elderly benefits increased by $8.6 billion, or 14.2%, reflecting growth in the number of recipients and changes in consumer prices, to which benefits are fully indexed. In addition, as announced in Budget 2021 and implemented in July 2022, the Old Age Security pension has permanently increased by 10% for seniors aged 75 and over. Children's benefits decreased by $1.7 billion, or 6.4%, largely reflecting the temporary Canada Child Benefit young child supplement in fiscal year 2022.

- Major transfers to other levels of government increased by $2.4 billion in 2023, primarily reflecting $3.7 billion in legislated growth under the Canada Health Transfer, the Canada Social Transfer, Equalization transfers and Territorial Formula Financing and a $1.5-billion increase in Canada-wide early learning and child care transfers. These increases were partly offset by a one-time transfer in 2022 of $1.0 billion under the Safe Long-term Care Fund and a $1.2-billion increase in the Quebec Abatement in 2023, which is accounted for as a reduction in transfer payments.

- Proceeds returned from the federal carbon pollution pricing framework increased by $3.2 billion, or 83.4%, reflecting the change in the delivery of the Climate Action Incentive payment, from an annual basis through personal income tax returns to a quarterly benefit, as well as an increase in Climate Action Incentive payment amounts.

- The CEWS decreased by $22.5 billion in 2023, reflecting the wind-down of the program in October 2021 and redeterminations of previous claims in 2023.

- Other transfer payments increased by $10.7 billion, or 12.1%, in 2023, in large part reflecting revised estimates for claims and contingent liabilities and allowances on loans, as well as increased international assistance. These increases were offset in part by the end of temporary COVID-19 programs and lower provisions for disaster assistance relative to provisions recorded in 2022 for flooding, wildfires, and storms in British Columbia.

- Other expenses of departments, agencies, and consolidated Crown corporations and other entities, excluding net actuarial losses, increased by $5.2 billion, or 4.1%, largely driven by revised estimates for claims and contingent liabilities, as well as increased personnel costs, partly offset by lower spending on the procurement and distribution of COVID-19 vaccines, therapeutics, medical supplies and equipment, and rapid tests.

- Public debt charges increased by $10.5 billion, or 42.7%, largely reflecting higher interest rates on market debt and pension and benefit obligations.

- Net actuarial losses, which reflect changes in the value of the government's obligations and assets for public sector pensions and other employee and veteran future benefits recorded in previous fiscal years, decreased $0.6 billion, or 5.5%, largely reflecting the end of the amortization period for certain prior years' net actuarial losses in 2022.

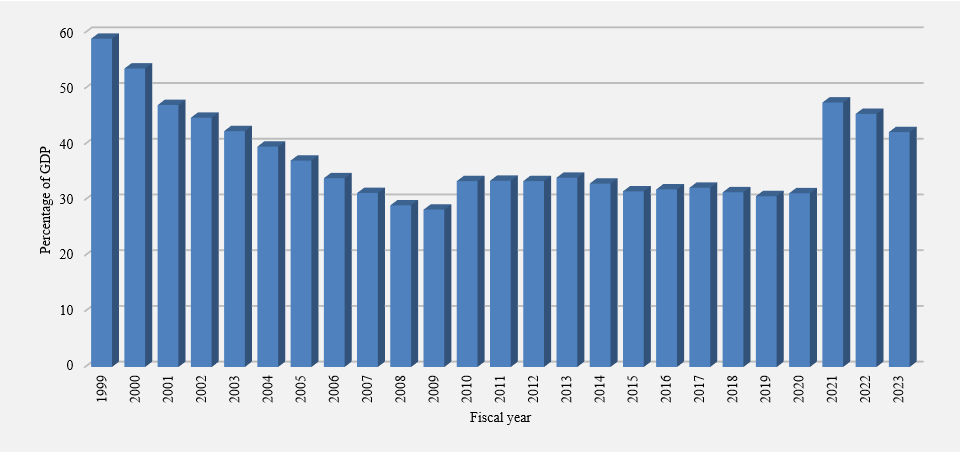

The expense ratio—expenses as a percentage of GDP—compares the total of all federal expenses to the size of the economy. This ratio is influenced by policy actions, economic developments, and changes in interest rates. The ratio stood at 17.4% in 2023 (down from 20.1% in 2022), largely reflecting the wind-down of temporary COVID-19 response measures.

Expense ratio

(expenses as a percentage of GDP)

Image Description

| Fiscal year | Program expenses | Public debt charges |

|---|---|---|

| 1999 | 12.4 | 4.6 |

| 2000 | 11.8 | 4.3 |

| 2001 | 11.8 | 4.0 |

| 2002 | 11.9 | 3.5 |

| 2003 | 12.3 | 3.1 |

| 2004 | 12.4 | 2.9 |

| 2005 | 13.4 | 2.6 |

| 2006 | 12.5 | 2.4 |

| 2007 | 12.7 | 2.3 |

| 2008 | 12.8 | 2.1 |

| 2009 | 13.2 | 1.7 |

| 2010 | 15.9 | 1.7 |

| 2011 | 14.7 | 1.7 |

| 2012 | 13.8 | 1.6 |

| 2013 | 13.7 | 1.4 |

| 2014 | 13.3 | 1.3 |

| 2015 | 12.8 | 1.2 |

| 2016 | 13.7 | 1.1 |

| 2017 | 14.2 | 1.0 |

| 2018 | 14.4 | 1.0 |

| 2019 | 14.4 | 1.0 |

| 2020 | 15.1 | 1.1 |

| 2021 | 28.2 | 0.9 |

| 2022 | 19.1 | 1.0 |

| 2023 | 16.1 | 1.3 |

Supporting Ukraine

Following Russia's full-scale invasion of Ukraine, Canada has supported the people of Ukraine as they fight for their sovereignty, democracy, and territorial integrity. Since January 2022, Canada has committed over $8.9 billion in financial, military, humanitarian, development, security and stabilization and immigration assistance to Ukraine. This assistance has included:

- $4.85 billion in loans to the Government of Ukraine to help deliver essential services to Ukrainians, including proceeds from the world-first $500 million Ukraine Sovereignty Bond, which allowed Canadians to support Ukraine directly;

- A €36.5 million (approximately $50 million) loan guarantee through the European Bank for Reconstruction and Development to facilitate support to Ukraine's state-owned energy company, Naftogaz;

- Over $1.8 billion in military aid and equipment donations, including for armoured vehicles; a National Advanced Surface-to-Air Missile System; 39 armoured combat support vehicles; four M777 howitzers; anti-tank weapons and small arms;

- The continuation of the Canadian Armed Forces' Operation UNIFIER, which has trained more than 35,000 members of Ukraine's security forces since 2015;

- Over $1 billion in immigration measures. Since March 2022, Canada has become a safe haven for over 171,000 Ukrainian citizens and their family members through the Canada-Ukraine authorization for emergency travel initiative. On March 22, 2023, the federal government announced that it was extending application intake for the Canada-Ukraine authorization for emergency travel to July 15, 2023, giving approved clients until March 31, 2024 to arrive in Canada;

- Over $352 million in humanitarian assistance;

- $115 million in grant assistance to repair Kyiv's power grid, provided through the World Bank Group Ukraine Relief, Recovery, Reconstruction and Reform Trust Fund. This contribution makes Canada the only G7 country thus far to meet a June 2022 G7 Leaders' commitment to explore opportunities to use revenues collected through tariff measures against Russia to assist Ukraine;

- $147 million in development assistance, which has supported the resilience of Ukraine's government institutions and civil society organizations and women's rights organizations, women's political and economic empowerment, policy, electoral and judicial reform, and provided grain storage solutions for farmers;

- Over $105 million in support for humanitarian demining operations, advancing accountability for human rights violations, supporting Ukrainian security sector institutions, cybersecurity, securing Ukraine's nuclear and radiological materials, and other peace and stability initiatives; and,

- Temporary duty relief for Ukrainian imports.

Comparison of actual results to budget projections

Comparison to March 2023 budget plan

The $35.3-billion deficit recorded in 2023 was $7.7 billion lower than the $43.0-billion deficit projected in the March 2023 federal budget.

- Overall, revenues were $10.6 billion higher than forecast primarily due to higher tax revenues driven by higher-than-expected corporate income tax revenues.

- Program expenses, excluding net actuarial losses, were $2.6 billion higher than expected, largely a result of higher-than-anticipated provisions for claims and contingent liabilities.

- Public debt charges were $0.5 billion higher than projected due to higher-than-expected interest charges on unmatured debt resulting from higher-than-anticipated borrowing requirements toward the end of the fiscal year, offset in part by lower-than-expected interest expenses on future benefit obligations.

- Net actuarial losses were $0.2 billion lower than projected.

| Projection | Actual | Difference | |

|---|---|---|---|

| Revenues | 437,251 | 447,815 | 10,564 |

| Expenses | |||

| Program expenses, excluding net actuarial losses | 435,928 | 438,555 | 2,627 |

| Public debt charges | 34,487 | 34,955 | 468 |

| Total expenses, excluding net actuarial losses | 470,415 | 473,510 | 3,095 |

| Annual operating deficit before net actuarial losses | (negative 33,163) | (negative 25,695) | 7,468 |

| Net actuarial losses | (negative 9,811) | (negative 9,627) | 184 |

| Annual operating deficit | (negative 42,974) | (negative 35,322) | 7,652 |

Comparison to April 2022 budget plan

The 2023 budgetary deficit of $35.3 billion was $17.5 billion lower than the $52.8-billion deficit projected for 2023 in the April 2022 federal budget.

Revenues were $39.4 billion, or 9.7%, higher than forecast in the April 2022 Budget, driven by higher income tax revenues as both personal and corporate income taxes showed continuously strong performances throughout the year.

Total expenses, excluding net actuarial losses, were $21.2 billion, or 4.7%, higher than projected in the April 2022 Budget, with program expenses $13.2 billion higher than forecast and public debt charges $8.1 billion higher than forecast.

- Major transfers to persons were $12.8 billion lower than forecast, largely attributable to the redetermination of benefits of COVID-19 income support for workers and the expiry of temporary measures to facilitate access to EI.

- Major transfers to other levels of government were $1.0 billion higher than projected, due to a $2.0-billion top-up to the Canada Health Transfer announced on March 25, 2023, partially offset by a $1 billion increase in the Quebec Abatement over the amount forecast.

- Proceeds from the pollution pricing framework returned were $1.1 billion lower than projected primarily due to revised timing of returning pollution pricing fuel charge proceeds to small and medium-sized businesses and Indigenous groups.

- Direct program expenses, which comprise the CEWS, other transfer payments, and other operating and capital amortization expenses, were $26.1 billion higher than projected in the April 2022 budget. The variance from forecast is largely a result of measures announced after the budget, including financial and other supports for Ukraine, supports for natural disaster events in the Atlantic provinces, settlement of the Gottfriedson Band Class suit, and an increase in provisions for claims and contingent liabilities and allowances. These higher expenses were partially offset by lower-than-forecast spending on the procurement and distribution of COVID-19 vaccines, therapeutics and rapid tests, and redeterminations of previous claims related to the CEWS.

- Public debt charges were $8.1 billion higher than expected in the April 2022 budget, reflecting higher-than-forecast interest on the government's pensions and other future benefits, higher interest rates on government bonds and treasury bills, and higher Consumer Price Index adjustments on Real Return Bonds, offset in part by lower-than-expected overall borrowing requirements.

- Net actuarial losses were $0.7 billion higher than projected, reflecting higher-than-forecast losses stemming from actuarial valuations prepared for the Public Accounts of Canada 2022, which were amortized starting in 2023.

| ProjectionLink to table note 1 | Actual | Difference | |

|---|---|---|---|

| Revenues | |||

| Income tax revenues | 276,619 | 315,004 | 38,385 |

| Other taxes and duties | 65,496 | 64,224 | (negative 1,272) |

| Employment insurance premiums | 25,801 | 26,914 | 1,113 |

| Proceeds from the pollution pricing framework | 8,221 | 8,041 | (negative 180) |

| Other revenues | 32,254 | 33,632 | 1,378 |

| Total revenues | 408,391 | 447,815 | 39,424 |

| Expenses | |||

| Program expenses | |||

| Major transfers to persons | 125,084 | 112,237 | (negative 12,847) |

| Major transfers to other levels of government | 89,827 | 90,784 | 957 |

| Proceeds from the pollution pricing framework returned | 8,046 | 6,996 | (negative 1,050) |

| Direct program expenses | |||

| Canada emergency wage subsidy | – | (negative 257) | (negative 257) |

| Other transfer payments | 86,263 | 99,199 | 12,936 |

| Other expenses, excluding net actuarial losses | 116,173 | 129,596 | 13,423 |

| Total program expenses, excluding net actuarial losses | 425,393 | 438,555 | 13,162 |

| Public debt charges | 26,904 | 34,955 | 8,051 |

| Total expenses, excluding net actuarial losses | 452,297 | 473,510 | 21,213 |

| Annual operating deficit before net actuarial losses | (negative 43,906) | (negative 25,695) | 18,211 |

| Net actuarial losses | (negative 8,923) | (negative 9,627) | (negative 704) |

| Annual operating deficit | (negative 52,829) | (negative 35,322) | 17,507 |

Accumulated deficit

The accumulated deficit is the difference between the government's total liabilities and total assets. It consists of the accumulated operating deficit and accumulated remeasurement gains and losses.

Remeasurement gains and losses represent unrealized gains and losses due to changes in the fair value of derivatives and certain other financial instruments held by the government, excluding gains and losses due to changes in foreign exchange rates, which are charged directly to the budgetary balance. Fair values of derivatives reported in the government's financial statements represent estimated amounts the government would have to receive or pay, based on market factors, if the agreements were terminated on March 31. The government uses derivatives, such as swap agreements and foreign exchange forward agreements, to manage financial risks and as a general practice holds these agreements to maturity.

Net remeasurement gains and losses also include other comprehensive income or loss reported by enterprise Crown corporations and other government business enterprises. Other comprehensive income or loss consists of certain unrealized gains and losses on Crown corporations' financial instruments and actuarial gains and losses related to their pensions and other employee future benefit plans.

The government began reporting remeasurement gains and losses in 2023 with the adoption of a new suite of financial instruments standards issued by the Public Sector Accounting Board (refer to Note 2 of the Consolidated Financial Statements of the Government of Canada in Section 2 of this volume). In accordance with those standards, remeasurement gains and losses are not included in the government's annual budgetary balance and are instead recorded directly as part of the accumulated deficit.

| 2023 | 2022 RestatedLink to table note 1 |

Difference | |

|---|---|---|---|

| Accumulated deficit at beginning of yearLink to table note 2 | (negative 1,142,538) | (negative 1,048,746) | (negative 93,792) |

| Change in accumulated operating deficit | |||

| Annual operating deficit | (negative 35,322) | (negative 90,315) | 54,993 |

| Other comprehensive income | – | 4,465 | (negative 4,465) |

| Total | (negative 35,322) | (negative 85,850) | 50,528 |

| Net remeasurement gains (losses) for the year | 4,847 | – | 4,847 |

| Accumulated deficit at end of year | (negative 1,173,013) | (negative 1,134,596) | (negative 38,417) |

| Accumulated deficit is comprised of: | |||

| Accumulated operating deficitLink to table note 3 | (negative 1,183,618) | (negative 1,139,975) | (negative 43,643) |

| Accumulated remeasurement gains (losses)Link to table note 3 | 10,605 | – | 10,605 |

| Total | (negative 1,173,013) | (negative 1,139,975) | (negative 33,038) |

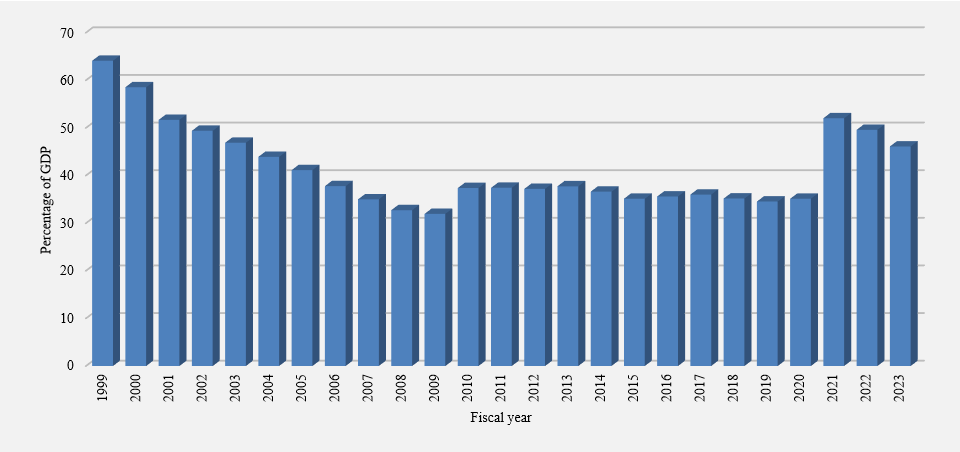

The accumulated deficit increased by $33.0 billion in 2023, reflecting the $35.3-billion budgetary deficit and a $2.6-billion increase to the opening balance of the accumulated deficit in 2022-23 on implementation of the new financial instruments standards, offset in part by $4.8 billion in net remeasurement gains. As a percentage of GDP, the accumulated deficit decreased 3.3 percentage points to 42.2% of GDP at March 31, 2023. The government is committed to reducing the accumulated deficit-to-GDP ratio over the medium term as its key fiscal anchor.

Graph - Accumulated deficit

(as a percentage of GDP)

Image Description

| Fiscal year | Percentage |

|---|---|

| 1999 | 58.9 |

| 2000 | 53.6 |

| 2001 | 47.0 |

| 2002 | 44.7 |

| 2003 | 42.3 |

| 2004 | 39.5 |

| 2005 | 37.0 |

| 2006 | 33.9 |

| 2007 | 31.2 |

| 2008 | 29.0 |

| 2009 | 28.2 |

| 2010 | 33.4 |

| 2011 | 33.4 |

| 2012 | 33.4 |

| 2013 | 34.0 |

| 2014 | 32.9 |

| 2015 | 31.5 |

| 2016 | 31.9 |

| 2017 | 32.2 |

| 2018 | 31.4 |

| 2019 | 30.7 |

| 2020 | 31.2 |

| 2021 | 47.5 |

| 2022 | 45.4 |

| 2023 | 42.2 |

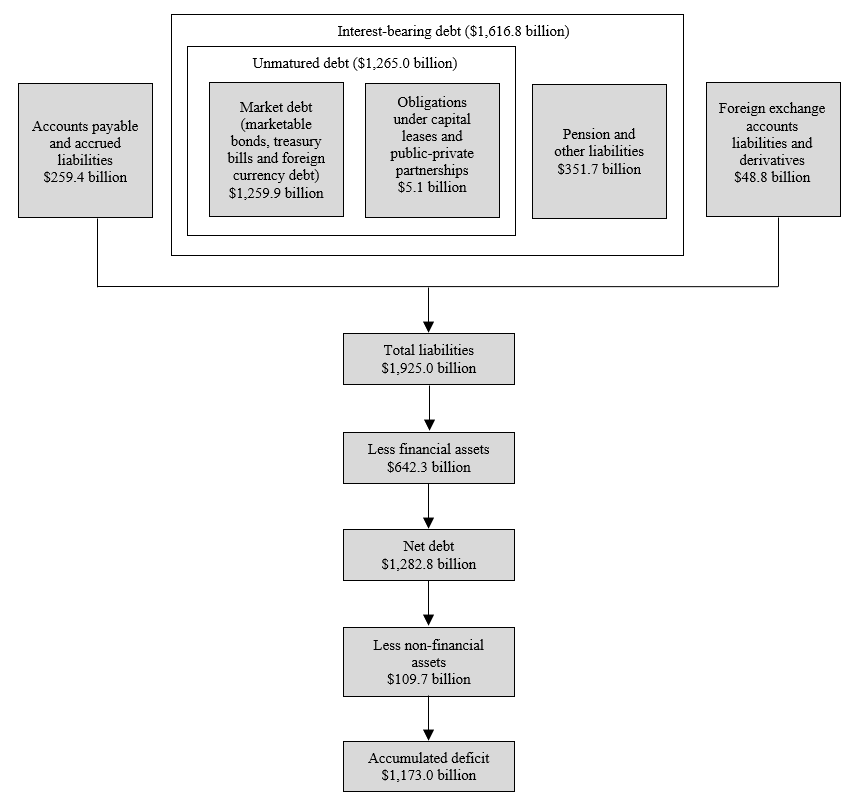

Measures of government debt

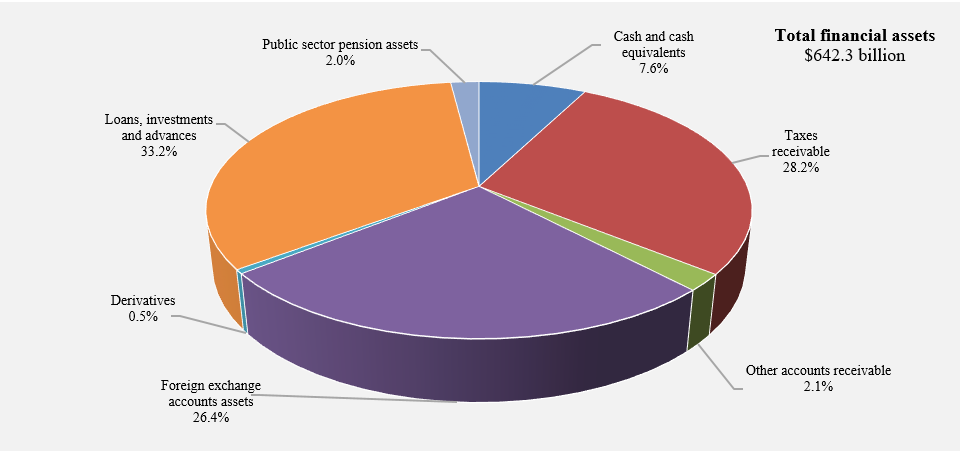

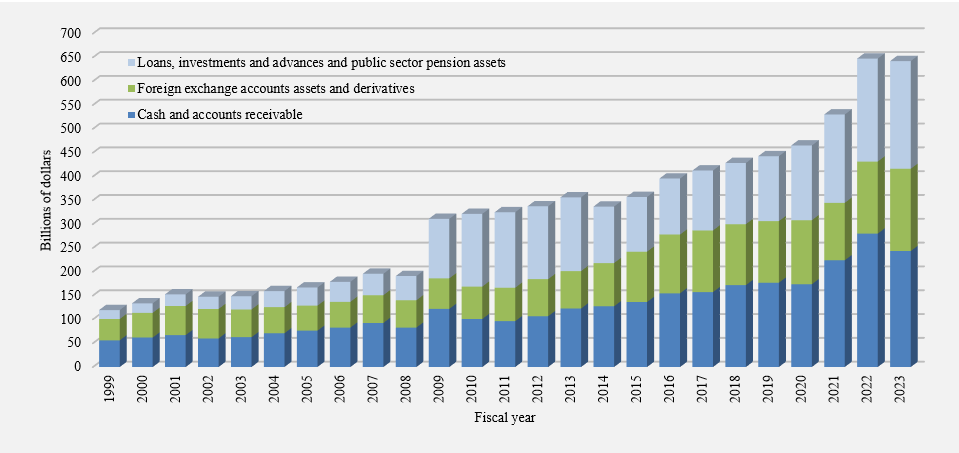

There are several generally accepted measures of government debt.

- Total liabilities of the government consist of unmatured debt (i.e., debt issued on the credit markets), pension and other future benefit liabilities, other interest-bearing liabilities, accounts payable and accrued liabilities, foreign exchange accounts liabilities, and derivative liabilities.

- Net debt is equal to the total liabilities of the government less its financial assets. Financial assets include cash and cash equivalents, accounts receivable, foreign exchange accounts assets, derivative assets, loans, investments and advances, and public sector pension assets.

- The accumulated deficit is equal to total liabilities less total assets – both financial and non-financial. Non-financial assets include primarily tangible capital assets, such as land and buildings, as well as inventories, and prepaid expenses. The accumulated deficit is the federal government's main measure of debt.

Measures of government debt chart

Image Description

The Measures of Government debt chart a total of 8 relationship boxes. The first 3 liability measurements align horizontally as follows: Unmatured debt which is made up of Market debt for $1,259.9 billion (marketable bonds, treasury bills, retail debt and foreign currency debt) and Market debt value adjustments and non-market debt for $5.1 billion; Pension and other liabilities for $351.7 billion; Accounts payable and accrued liabilities for $259.4 billion and Foreign exchange accounts liabilities and derivatives for $48.8 billion. The remaining measurement relationship boxes are aligned vertically below as follows: Total liabilities for $1,925.0 billion; Less financial assets for $642.3 billion; Net debt for $1,282.8 billion; Less non-financial assets for $109.7 billion; and Accumulated deficit for $1,173.0 billion.

The following sections provide more details on each of these components.

| 2023 | 2022 RestatedLink to table note 1 |

Difference | |

|---|---|---|---|

| Liabilities | |||

| Accounts payable and accrued liabilities | 259,440 | 262,529 | (negative 3,089) |

| Interest-bearing debt | |||

| Unmatured debt | 1,265,040 | 1,249,957 | 15,083 |

| Pensions and other future benefits | 344,374 | 327,371 | 17,003 |

| Other liabilities | 7,339 | 7,707 | (negative 368) |

| Total | 1,616,753 | 1,585,035 | 31,718 |

| Foreign exchange accounts liabilities | 44,151 | 42,252 | 1,899 |

| Derivatives | 4,689 | 2,471 | 2,218 |

| Total liabilities | 1,925,033 | 1,892,287 | 32,746 |

| Financial assets | |||

| Cash and accounts receivable | 243,520 | 280,052 | (negative 36,532) |

| Foreign exchange accounts assets | 169,390 | 146,283 | 23,107 |

| Derivatives | 3,260 | 4,974 | (negative 1,714) |

| Loans, investments and advances | 213,110 | 207,031 | 6,079 |

| Public sector pension assets | 12,996 | 9,203 | 3,793 |

| Total financial assets | 642,276 | 647,543 | (negative 5,267) |

| Net debt | (negative 1,282,757) | (negative 1,244,744) | (negative 38,013) |

| Non-financial assets | 109,744 | 104,769 | 4,975 |

| Accumulated deficit | (negative 1,173,013) | (negative 1,139,975) | (negative 33,038) |

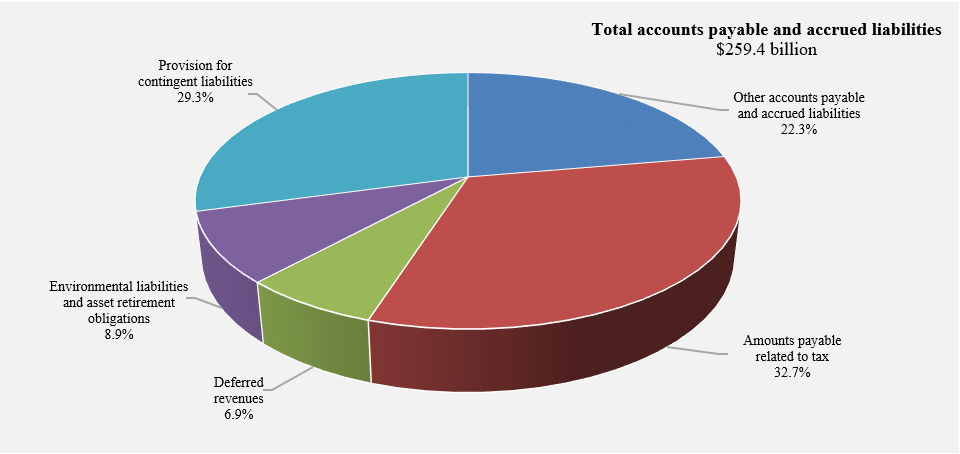

Accounts payable and accrued liabilities

The government's accounts payable and accrued liabilities consist of amounts payable related to tax based on assessments and estimates of refunds owing for tax assessments not completed by year-end; provisions for contingent liabilities, including guarantees provided by the government and claims and pending and threatened litigation; environmental liabilities and asset retirement obligations, which include estimated costs related to the remediation of contaminated sites and the future retirement of certain tangible capital assets; deferred revenue; and other accounts payable and accrued liabilities. Other accounts payable and accrued liabilities include items such as accrued salaries and benefits; amounts payable to provinces, territories and Indigenous governments for taxes collected and administered on their behalf in accordance with tax agreements; and amounts owing at year-end pursuant to contractual arrangements or for work performed or goods received.

Accounts payable and accrued liabilities by category for 2023

Note: Numbers may not add to 100% due to rounding.

Image Description

| Accounts payable and accrued liabilities | Percentage |

|---|---|

| Other accounts payable and accrued liabilities | 22.3% |

| Amounts payable related to tax | 32.7% |

| Deferred revenues | 6.9% |

| Environmental liabilities and asset retirement obligations | 8.9% |

| Provision for contingent liabilities | 29.3% |

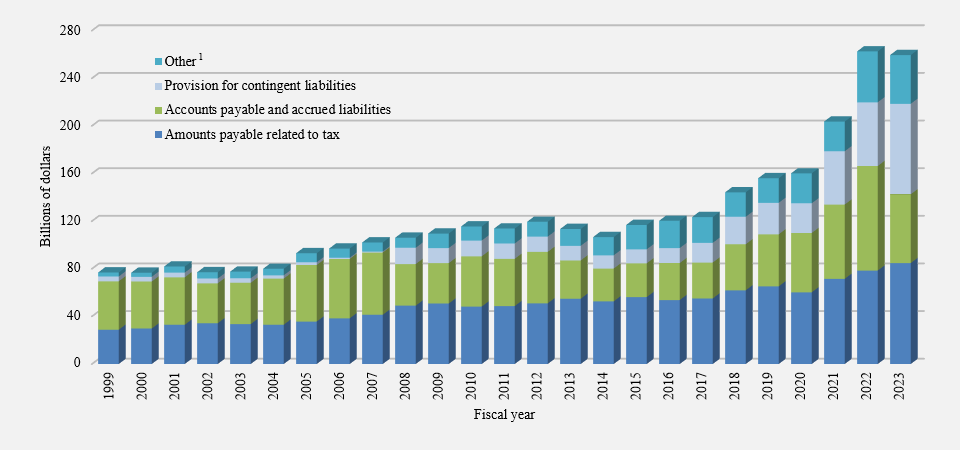

At March 31, 2023, accounts payable and accrued liabilities totalled $259.4 billion, down $3.1 billion from March 31, 2022. This decrease reflects a large decline in other accounts payable and accrued liabilities as well as smaller decreases in deferred revenue and environmental liabilities and asset retirement obligations, offset in part by growth in provisions for contingent liabilities and amounts payable related to tax.

- Amounts payable related to tax increased by $6.3 billion in 2023, from $78.5 billion at March 31, 2022, to $84.7 billion at March 31, 2023. This increase largely reflects higher refundable GST/HST credit returns and the accrual of the Grocery Rebate announced in Budget 2023, as well as higher accrued payables for individual income tax, offset in part by lower accrued payables for corporate income tax.

- Provisions for contingent liabilities increased by $22.6 billion, largely reflecting increased provisions for claims and litigation, including the revised final settlement for compensation related to the First Nations Child and Family Services program and Jordan's Principle and increases in provisions for specific claims and comprehensive land claims.

- Environmental liabilities and asset retirement obligations decreased by $0.8 billion in 2023, largely reflecting revisions to estimated provisions for asset retirement obligations, including the impact of year-over-year changes in discount rates used to estimate the present value of these obligations, as well as remediation activities undertaken in 2023.

- Deferred revenue decreased by $1.1 billion in 2023, largely reflecting the amortization of proceeds from prior years' spectrum auctions.

- Other accounts payable and accrued liabilities decreased by $30.1 billion in 2023. Within this component, liabilities under provincial, territorial and Indigenous tax agreements decreased by $20.9 billion, largely reflecting underestimated amounts of personal and corporate income tax for prior years being paid to provinces and territories in 2023, as well as the timing differences in payments to provinces and territories. Accounts payable decreased by $11.0 billion due to a number of factors including a decrease in the amount owing to the Canada Pension Plan (CPP) at year end for CPP contributions collected by the government; a decrease in accrued liabilities for disaster assistance due to payments made during 2023 and changes in estimates; payments made under various claims during the year, including under the First Nations Drinking Water Settlement; and the payment of various transfers to provinces and territories accrued at the end of 2022. These decreases were offset in part by a $1.8-billion increase in accrued salaries and benefits.

Accounts payable and accrued liabilities have increased significantly in recent years, from $123.4 billion at March 31, 2017 to $259.4 billion at March 31, 2023. This increase is due in large part to increased provisions for contingent liabilities; growth in amounts payable related to tax, reflecting growth in the tax base; and, an increase in accounts payable pursuant to contractual agreements, for work performed, goods received, and services rendered.

Graph - Accounts payable and accrued liabilities

Note 1: Other includes provisions for environmental liabilities and asset retirement obligations and deferred revenues.

(in billions of dollars)

Image Description

| Fiscal year | Amounts payable related to tax | Accounts payable and accrued liabilities | Provision for contingent liabilities | OtherLink to table note 1 |

|---|---|---|---|---|

| 1999 | 29 | 41 | 4 | 3 |

| 2000 | 30 | 40 | 4 | 3 |

| 2001 | 33 | 40 | 4 | 5 |

| 2002 | 34 | 33 | 4 | 5 |

| 2003 | 34 | 35 | 4 | 6 |

| 2004 | 33 | 39 | 3 | 5 |

| 2005 | 36 | 48 | 2 | 8 |

| 2006 | 38 | 50 | 1 | 8 |

| 2007 | 41 | 52 | 1 | 8 |

| 2008 | 49 | 35 | 14 | 8 |

| 2009 | 51 | 34 | 13 | 12 |

| 2010 | 48 | 42 | 13 | 12 |

| 2011 | 49 | 40 | 13 | 13 |

| 2012 | 51 | 43 | 13 | 13 |

| 2013 | 55 | 32 | 12 | 14 |

| 2014 | 53 | 28 | 11 | 15 |

| 2015 | 56 | 28 | 12 | 20 |

| 2016 | 54 | 31 | 13 | 23 |

| 2017 | 55 | 30 | 17 | 22 |

| 2018 | 62 | 39 | 23 | 21 |

| 2019 | 65 | 44 | 26 | 21 |

| 2020 | 60 | 50 | 25 | 25 |

| 2021 | 72 | 62 | 45 | 25 |

| 2022 | 78 | 88 | 53 | 43 |

| 2023 | 85 | 58 | 76 | 41 |

Interest-bearing debt

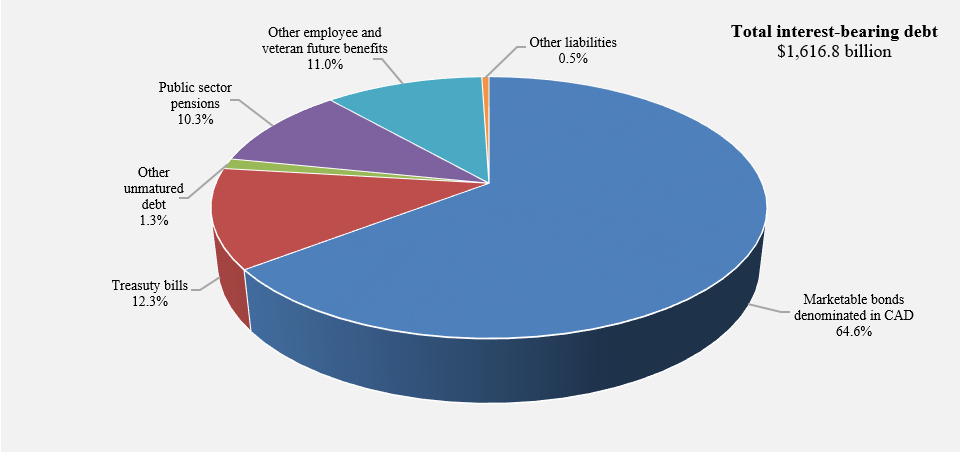

Interest-bearing debt includes unmatured debt, or debt issued on the credit markets, pension and other future benefit liabilities, and other liabilities.

- Unmatured debt, which includes fixed-coupon marketable bonds, Real Return Bonds, treasury bills, foreign-currency-denominated debt, and obligations related to capital leases and public-private partnerships, amounted to 78.2% of interest-bearing debt at March 31, 2023.

- Pension and other future benefit liabilities include obligations for: federal public sector pensions sponsored by the government; disability and associated benefits available to war veterans, current and retired members of the Canadian Forces and the Royal Canadian Mounted Police, their survivors and dependants; health care and dental benefits available to retired employees and their dependants; accumulated sick leave entitlements; severance benefits; workers' compensation benefits; and other future benefits sponsored by some consolidated Crown corporations and other entities. Liabilities for public sector pensions made up 10.3% of interest-bearing debt, and other employee and veteran future benefits accounted for an additional 11.0% of interest-bearing debt.

- The remaining 0.5% of interest-bearing debt represents other interest-bearing liabilities of the government, which include deposit and trust accounts and other specified purpose accounts.

The share of total interest-bearing debt represented by unmatured debt had been declining since the mid-1990s, as the government was able to retire some of this debt. This trend reversed in 2009 due to the increase in financial requirements stemming from the recession and stimulus measures introduced to mitigate its impacts, as well as an increase in borrowings under the consolidated borrowing framework introduced in 2008. Under the consolidated borrowing framework, the government finances all of the borrowing needs of the Canada Mortgage and Housing Corporation (CMHC), the Business Development Bank of Canada (BDC) and Farm Credit Canada (FCC) through direct lending in order to reduce overall borrowing costs and improve the liquidity of the government securities market. More recently, increased financial requirements stemming from the COVID-19 pandemic and Canada's Economic Response Plan contributed to a further increase in unmatured debt as a portion of interest-bearing debt.

Graph - Interest-bearing debt by category for 2023

Note: Numbers may not add to 100% due to rounding.

Image Description

| Interest bearing debt | Percentage |

|---|---|

| Marketable bonds denominated in CAD | 64.6% |

| Treasury bills | 12.3% |

| Other unmatured debt | 1.3% |

| Public sector pensions | 10.3% |

| Other employee and veteran future benefits | 11% |

| Other liabilities | 0.5% |

At March 31, 2023, interest-bearing debt totalled $1,616.8 billion, up $31.7 billion from March 31, 2022. Within interest-bearing debt, unmatured debt increased by $15.1 billion and liabilities for other employee and veteran future benefits increased by $18.2 billion, while liabilities for public sector pensions decreased by $1.2 billion and other liabilities decreased by $0.4 billion.

The $15.1-billion increase in unmatured debt is largely attributable to a $15.3-billion increase in market debt and related unamortized discounts and premiums, reflecting increased borrowings to meet the government's financial requirements.

The Bank of Canada and the Department of Finance Canada manage the government's unmatured debt and associated risks. The fundamental objective of the debt management strategy is to provide stable, low-cost funding to meet the government's financial obligations and liquidity needs. The vast majority of debt is denominated in Canadian dollars. There is a small amount of borrowings denominated in US dollars, which fund a portion of the foreign exchange reserves. The reserves are managed under an asset-liability matching framework, and foreign exchange and interest rate risks are mitigated. Details on the government's debt management objectives, strategy, borrowing plans, and debt management activities are tabled annually in Parliament through the Department of Finance Canada's Debt Management Strategy and Debt Management Report.

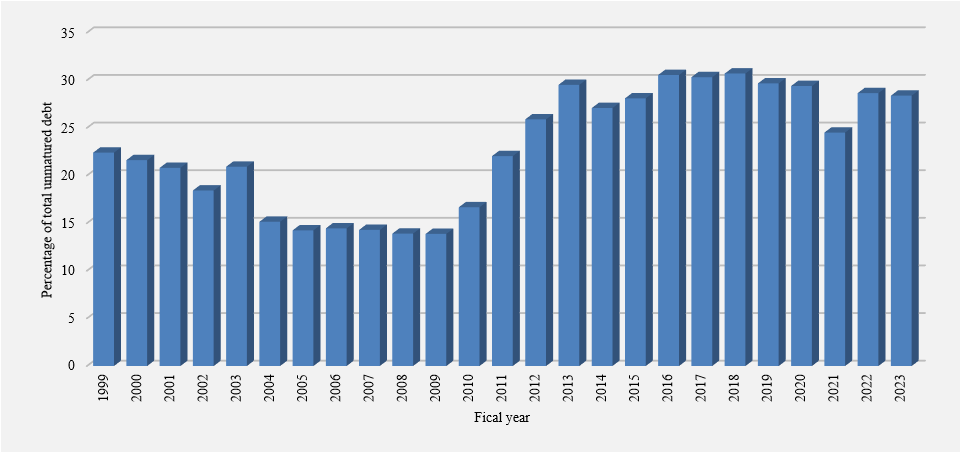

Foreign holdings of the government's unmatured debt are estimated at $361.8 billion at March 31, 2023, representing approximately 28.6% of the government's total unmatured debt, similar to their proportion at March 31, 2022.

Foreign holdings of Government of Canada unmatured debt

(as a percentage of unmatured debt)

Source: Statistics Canada

Image Description

| Fiscal year | Percentage |

|---|---|

| 1999 | 22.4 |

| 2000 | 21.6 |

| 2001 | 20.8 |

| 2002 | 18.4 |

| 2003 | 20.9 |

| 2004 | 15.1 |

| 2005 | 14.2 |

| 2006 | 14.5 |

| 2007 | 14.3 |

| 2008 | 13.9 |

| 2009 | 13.9 |

| 2010 | 16.7 |

| 2011 | 22.0 |

| 2012 | 25.9 |

| 2013 | 29.5 |

| 2014 | 27.1 |

| 2015 | 28.1 |

| 2016 | 30.6 |

| 2017 | 30.3 |

| 2018 | 30.7 |

| 2019 | 29.7 |

| 2020 | 29.4 |

| 2021 | 24.5 |

| 2022 | 28.6 |

| 2023 | 28.4 |

The government's liabilities for pensions and other future benefits stood at $344.4 billion at March 31, 2023, up $17.0 billion from the prior year. These liabilities reflect the estimated present value of pensions and other future benefits earned to March 31, 2023, by current and former employees, as measured annually on an actuarial basis, net of the value of assets set aside for funding purposes. Liabilities for pensions and other future benefits do not include benefits payable under the CPP. The CPP is not consolidated in the government's financial statements because changes to the CPP require the agreement of two-thirds of participating provinces and it is therefore not controlled by the government. Further information regarding the CPP can be found in Section 6 of this volume.

Accounting for public sector pensions and other employee and veteran future benefits

The government's $344.4-billion liability for public sector pensions and other employee and veteran future benefits results from its promise to provide certain benefits to employees, veterans, Members of Parliament, and employees of territorial governments during or after employment, or in retirement, in return for their service.

For benefits that accumulate over time as employees work, such as pensions, an annual expense and liability are generally recorded for the estimated cost of benefits earned by employees during the year. The government uses an actuarial cost method (the projected benefit method prorated on service) to estimate this expense and liability. Under this method, the government estimates the total expected future benefit payments for current employees. This total is then prorated over employees' eligible period of employment. This means that an equal portion of the estimate is expensed as current service cost in each year of an employee's eligible period of service, on a present value basis, assuming no change in discount rates and assumptions. Several actuarial assumptions are used in calculating current service cost, including future inflation, interest rates, return on pension investments, general wage increases, workforce composition, retirement rates and mortality rates.

For benefits or compensated absences that do not vest or accumulate, such as veteran future benefits and workers' compensation, a liability and expense for the expected cost of providing future benefits is recognized immediately in the period when the obligating event occurs. For example, some benefits provided to employees in the event of an accident or injury are recorded when the accident or injury occurs.

Since April 1, 2000, amounts equal to contributions less benefit payments and other charges that fall within the Income Tax Act limits are transferred to the Public Sector Pension Investment Board (PSPIB) for investment in relation to the public service, Canadian Forces–Regular Force and Royal Canadian Mounted Police pension plans, and since 2007 for the Canadian Forces–Reserve Force pension plan. Pension assets held by the PSPIB are valued at a market-related value. The government's accrued benefit obligations for public sector pensions and other employee and veteran future benefits are presented net of pension assets, as well as unrecognized net actuarial gains and losses (discussed below) and amounts related to the plans of some consolidated Crown corporations and other entities, in arriving at the liability for pensions and other future benefits shown on the Consolidated Statement of Financial Position.

Since the government's obligations for pensions and other future benefits are recorded on a present value basis, interest expense is recorded each year and added to the obligations to reflect the passage of time, as these liabilities are one year closer to settlement. Interest expense is recorded net of the expected return on the market-related value of investments for funded pension benefits and reported as part of public debt charges. Current service cost is recorded as part of other expenses excluding net actuarial losses on the Consolidated Statement of Operations and Accumulated Operating Deficit.

When an employee ceases employment with the government, the government stops recording current service cost in respect of that employee. Benefits subsequently provided to the employee are recorded as reductions in the government's benefit obligations.

The government's obligations for pensions and other future benefits are re-estimated on an annual basis to reflect actual experience and updated actuarial assumptions. Increases or decreases in the estimated value of the obligations are referred to as actuarial gains and losses. Actuarial gains and losses also result from differences between actual and expected returns on pension assets. Under Canadian public sector accounting standards, actuarial gains and losses are not recognized in the government's liabilities immediately due to their tentative nature and because further adjustments may be required in the future. Instead, these amounts are recognized to expense and to the government's liabilities over the expected average remaining service life of employees, which represents periods ranging from 4 to 23 years according to the plan in question, or the average remaining life expectancy of benefit recipients under wartime veteran plans, which represents periods ranging from 5 to 7 years.

Any plan amendments, curtailments and settlements that affect accrued benefit obligations for services already rendered by employees and veterans are reflected in the government's obligations in the period of the amendment, curtailment or settlement and recorded as part of other expenses excluding net actuarial losses.

The following table illustrates the change in the government's liabilities for pensions and other future benefits, net of public sector pension assets, in 2023.

| Pensions | Other future benefits | Total | |

|---|---|---|---|

| Net future benefit liabilities at beginning of year | 158,463 | 159,705 | 318,168 |

| Add: | |||

| Benefits earned during the year | 8,820 | 12,310 | 21,130 |

| Interest on accrued benefit obligations, net of the expected return on investments | 2,343 | 5,570 | 7,913 |

| Net actuarial losses recognized during the year | 1,077 | 8,550 | 9,627 |

| Plan amendment and valuation allowance | 754 | (negative 1,322) | (negative 568) |

| Subtotal | 12,994 | 25,108 | 38,102 |

| Deduct: | |||

| Benefits paid during the yearLink to table note 1 | 14,819 | 6,757 | 21,576 |

| Transfers to the PSPIB and net use of funds held in external trustsLink to table note 2 | 2,433 | (negative 1) | 2,432 |

| Transfers to other plans and administrative expenses | 776 | 108 | 884 |

| Subtotal | 18,028 | 6,864 | 24,892 |

| Net (decrease) increase | (negative 5,034) | 18,244 | 13,210 |

| Net future benefit liabilities at end of year | 153,429 | 177,949 | 331,378 |

| Presented on the Consolidated Statement of Financial Position as: | |||

| Public sector pension liabilities | 166,425 | ||

| Other employee and veteran future benefit liabilities | 177,949 | ||

| Total pension and other future benefit liabilities | 344,374 | ||

| Public sector pension assets | 12,996 | ||

| Net pensions and other future benefit liabilities | 331,378 | ||

The increase in net liabilities for pensions and other future benefits in 2023 reflects the addition of $21.1 billion in future benefits earned by employees during the year, as well as $7.9 billion in net interest charges on the liabilities. The discount rates used in the measurement of the government-sponsored unfunded pension and other future benefit obligations and in calculating interest charges on the obligations are based on the actual zero-coupon yield curve for Government of Canada bonds at fiscal year-end. The discount rates used to value the government's obligations for funded pension benefits, which relate to post-March 2000 service that falls within the Income Tax Act limits under its three main pension plans–the public service, Canadian Forces–Regular Force, and Royal Canadian Mounted Police pension plans–as well as benefits under the Canadian Forces–Reserve Force pension plan are based on the streamed expected rates of return on invested funds.

The government's liabilities for pensions and other future benefits increased by an additional $9.6 billion in 2023 due to the recognition of net actuarial losses. As of March 31, 2023, the government had net unamortized losses of $18.3 billion. These losses will be amortized over time and recorded as part of net actuarial losses and as an increase in the government's liabilities.

These increases were offset in part by reductions in the liabilities for benefits paid during the year ($21.6 billion), net transfers to the PSPIB and net use of funds held in external trusts ($2.4 billion), transfers to other plans and administrative expenses ($0.9 billion), and the net impact of a plan amendment and valuation allowance ($0.6 billion).

Further details on the federal public sector pensions and other employee and veteran future benefits are contained in Section 6 of this volume.

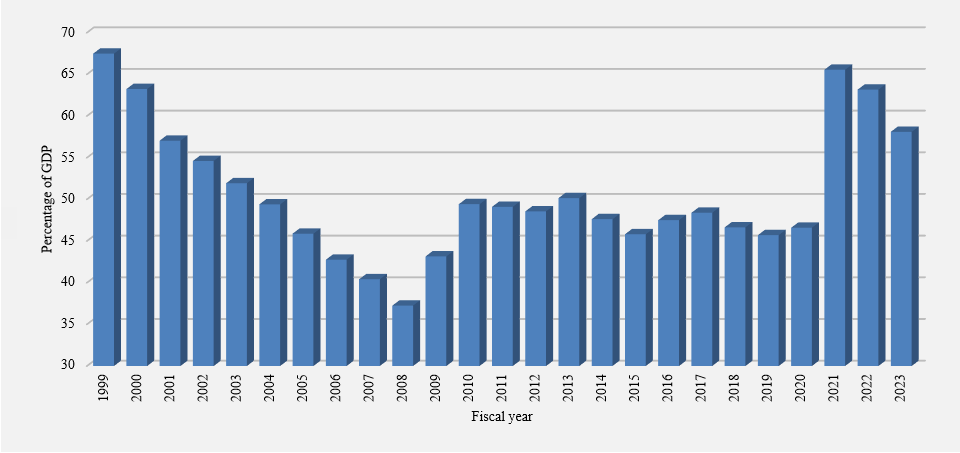

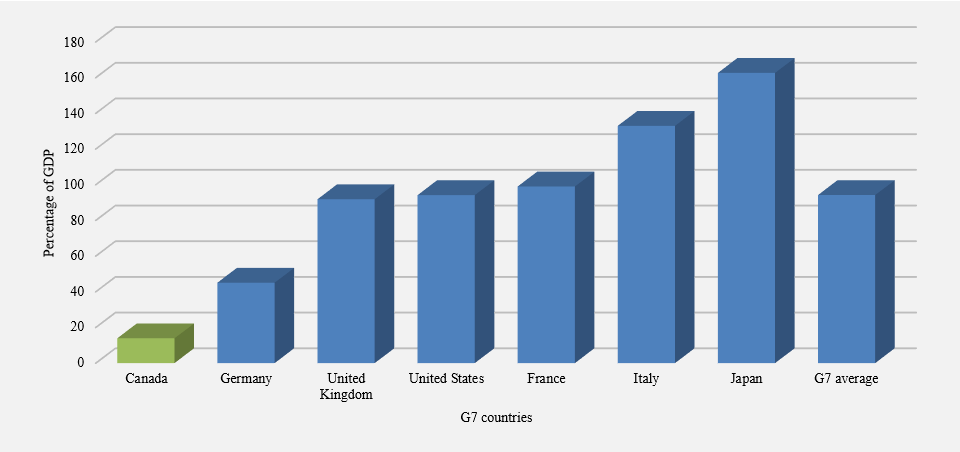

Interest-bearing debt stood at 58.1% of GDP in 2023, down from 63.2% in 2022. The increase since 2020 shown in the chart below reflects borrowings undertaken to meet the government's financial requirements under the COVID-19 Economic Response Plan. As of 2023, this ratio is down 16.8 percentage points from its high of 74.9% in 1996.

Graph - Interest-bearing debt

(as a percentage of GDP)

Image Description

| Fiscal year | Percentage |

|---|---|

| 1999 | 67.5 |

| 2000 | 63.2 |

| 2001 | 57.0 |

| 2002 | 54.6 |

| 2003 | 51.9 |

| 2004 | 49.4 |

| 2005 | 45.9 |

| 2006 | 42.8 |

| 2007 | 40.4 |

| 2008 | 37.2 |

| 2009 | 43.2 |

| 2010 | 49.4 |

| 2011 | 49.1 |

| 2012 | 48.6 |

| 2013 | 50.1 |

| 2014 | 47.6 |

| 2015 | 45.8 |

| 2016 | 47.5 |

| 2017 | 48.4 |

| 2018 | 46.6 |

| 2019 | 45.7 |

| 2020 | 46.6 |

| 2021 | 65.6 |

| 2022 | 63.2 |

| 2023 | 58.1 |

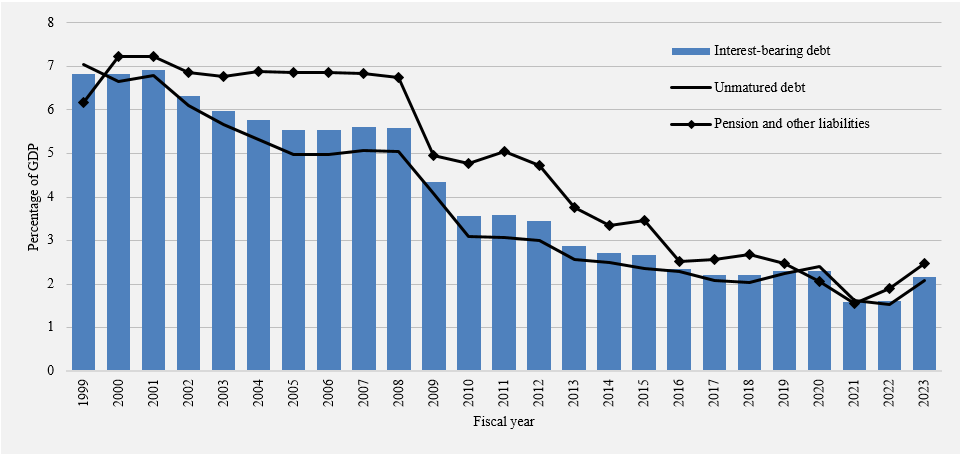

The average effective interest rate on the government's interest-bearing debt in 2023 was 2.2%, up from 1.6% in 2022. The average effective interest rate on unmatured debt was 2.1%, while the average effective interest rate on pension and other liabilities was 2.5%.

Average effective interest rate on interest-bearing debt

(in percentage)

Image Description

| Fiscal year | Interest-bearing debt percentage | Unmatured debt percentage | Pension and other liabilities percentage |

|---|---|---|---|

| 1999 | 6.8 | 7.0 | 6.2 |

| 2000 | 6.8 | 6.7 | 7.2 |

| 2001 | 6.9 | 6.8 | 7.2 |

| 2002 | 6.3 | 6.1 | 6.9 |

| 2003 | 6.0 | 5.7 | 6.8 |

| 2004 | 5.8 | 5.3 | 6.9 |

| 2005 | 5.5 | 5.0 | 6.9 |

| 2006 | 5.5 | 5.0 | 6.9 |

| 2007 | 5.6 | 5.1 | 6.8 |

| 2008 | 5.6 | 5.1 | 6.7 |

| 2009 | 4.3 | 4.1 | 5.0 |

| 2010 | 3.6 | 3.1 | 4.8 |

| 2011 | 3.6 | 3.1 | 5.0 |

| 2012 | 3.5 | 3.0 | 4.7 |

| 2013 | 2.9 | 2.6 | 3.8 |

| 2014 | 2.7 | 2.5 | 3.4 |

| 2015 | 2.7 | 2.4 | 3.5 |

| 2016 | 2.3 | 2.3 | 2.5 |

| 2017 | 2.2 | 2.1 | 2.6 |

| 2018 | 2.2 | 2.0 | 2.7 |

| 2019 | 2.3 | 2.2 | 2.5 |

| 2020 | 2.3 | 2.4 | 2.1 |

| 2021 | 1.6 | 1.6 | 1.5 |

| 2022 | 1.6 | 1.5 | 1.9 |

| 2023 | 2.2 | 2.1 | 2.5 |

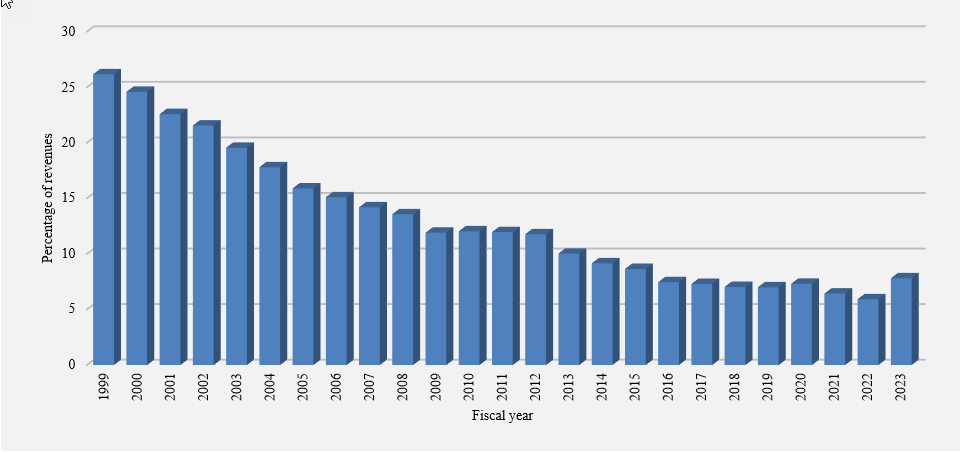

The interest ratio (public debt charges as a percentage of revenues) shows the proportion of every dollar of revenue that is needed to pay interest and is therefore not available to pay for program initiatives. The interest ratio had been decreasing in recent years, falling from a peak of 37.6% in 1991 to 5.9% in 2022. The ratio increased to 7.8% in 2023, reflecting an increase in interest rates. This means that, in 2023, the government spent approximately 8 cents of every revenue dollar on servicing the public debt.

Interest ratio

(public debt charges as a percentage of revenues)

Image Description

| Fiscal year | Percentage |

|---|---|

| 1999 | 26.2 |

| 2000 | 24.6 |

| 2001 | 22.6 |

| 2002 | 21.6 |

| 2003 | 19.6 |

| 2004 | 17.8 |

| 2005 | 15.9 |

| 2006 | 15.1 |

| 2007 | 14.2 |

| 2008 | 13.6 |

| 2009 | 11.9 |

| 2010 | 12.0 |

| 2011 | 12.0 |

| 2012 | 11.8 |

| 2013 | 10.0 |

| 2014 | 9.2 |

| 2015 | 8.6 |

| 2016 | 7.5 |

| 2017 | 7.3 |

| 2018 | 7.0 |

| 2019 | 7.0 |

| 2020 | 7.3 |

| 2021 | 6.4 |

| 2022 | 5.9 |

| 2023 | 7.8 |

Foreign exchange accounts liabilities and derivatives

Foreign exchange accounts liabilities include Special Drawing Rights (SDR) allocations and notes payable to the International Monetary Fund (IMF). The SDR is an international reserve asset created by the IMF and allocated to countries participating in its Special Drawing Rights Department. SDRs represent both an asset (a holder of SDRs has the right to exchange them for an equivalent amount of freely usable currency, or other reserve assets, of other countries participating in the IMF's SDR Department) and a liability (an allocation of SDRs by the IMF entails an obligation to provide, on demand, an equivalent amount of freely usable currency to another IMF member). SDR holdings are recorded in foreign exchange accounts assets, which are presented separately from foreign exchange accounts liabilities starting in 2023. The government's foreign exchange accounts liabilities at March 31, 2023, stood at $44.2 billion, up $1.9 billion from a year earlier primarily due to foreign exchange rate movements, which resulted in the liabilities appreciating against the Canadian dollar.