Reporting instructions for Crown corporations and other reporting entities

The purpose of these instructions is to advise officials of Crown corporations (CC) and other reporting entities of the financial information required at the end of each calendar quarter, in order to report the financial position, results of operations, contingent liabilities, contractual obligations, particulars of insurance programs and guarantee funds of all Crown corporations and other reporting entities in the Public Accounts of Canada, in prospectuses of the Government of Canada and Crown corporations and for analysis purposes.

On this page

- 1. Revision history of the reporting instructions

- 2. Purpose of the reporting instructions for Crown corporations and other reporting entities

- 3. Responsibilities of the chief executive officer

- 4. Definitions related to these instructions

- 5. Reporting procedures

- 5.1 Assets, liabilities and equity

- 5.2 Revenues, expenses and other comprehensive income

- 5.3 Equity accounts

- 5.4 Annual supplementary information on capital assets and assets under capital leases

- 5.5 Supplementary information on borrowings, contingent liabilities, contingent assets, contractual obligations and contractual rights

- 5.6 Change in accounting policies or unusual transactions

- 5.7 Reconciliation between International Financial Reporting Standards and Public Sector Accounting Standards

- 5.8 Related party transactions

- 5.9 Insurance programs

- 5.10 List of Crown corporations and other reporting entities

- 5.11 Annual report

- 5.12 Frequency of reporting

- 5.13 Submission of forms

- 6. Enquiries

- Appendix A: List of Crown corporations and other reporting entities

- Appendix B: List of government organizations—Departments and agencies

1. Revision history of the reporting instructions

Note

When a section is revised, it supersedes the previous one. The revision icon  at the beginning of a paragraph is used to identify changes.

at the beginning of a paragraph is used to identify changes.

| Revision number | Issuing date | Significant changes |

|---|---|---|

| Revision 18 | 2024-03-19 |

The revision includes the following change to the forms for all Crown corporations:

The revision includes the following changes to the forms for consolidated Crown corporations only:

|

| Revision 17 | 2023-03-13 |

The revision includes the following changes to the forms for consolidated Crown corporations only:

|

| Revision 16 | 2022-03-14 |

The revision includes the following changes:

|

| Revision 15 | 2021-03-09 |

The revision includes the following changes:

|

| Amendment 1 to revision 14 | 2020-03-27 | The submission dates for the 2019-2020 year-end requirements have been extended to May 21 for the preliminary amounts and to June 12 for the final amounts |

| Revision 14 | 2020-02-14 | The revision includes the following changes:

|

| Revision 13 | 2019-03-20 | The revision includes the following changes:

|

2. Purpose of the reporting instructions for Crown corporations and other reporting entities

The information requested from Crown corporations is a result of a recommendation included in the 1963 third report of the Public Accounts Committee. The Treasury Board Secretariat has expanded this recommendation to include other reporting entities that are also considered part of the government reporting entity. Information obtained is used to prepare annual financial statements and tables in the Public Accounts of Canada for disclosure in prospectuses of the Government of Canada and Crown corporations and for analysis purposes.

The reporting entity of the Government of Canada includes all of the government organizations which comprise the legal entity of the government as well as other organizations, including Crown corporations, which are separate legal entities but are controlled by the government. For financial reporting purposes, control is defined as the power to govern the financial and operating policies of an organization with benefits from the organization's activities being expected, or the risk of loss being assumed by the government.

A Crown corporation is a government organization that operates following a private sector model but usually has a mixture of commercial and public policy objectives. A Crown corporation means a parent Crown corporation or a wholly-owned subsidiary. A parent Crown corporation is wholly-owned directly by the government and is established through legislation, letters patent or articles of incorporation under the Canada Business Corporations Act. A wholly-owned subsidiary is wholly-owned by one or more parent Crown corporations, directly or indirectly through any number of subsidiaries. Wholly-owned subsidiaries report to their parent Crown corporations, except those that have been directed by the government to report as a parent Crown corporation.

A number of corporations are not considered Crown corporations within the meaning of the Financial Administration Act. In most cases, however, they are controlled by the government and accountable to Parliament through a minister of the Crown for the conduct of their affairs.

In addition, a number of not-for-profit organizations, such as foundations, meet the definition of control for financial reporting purposes and are part of the government's reporting entity.

Consolidated Crown corporations and other entities stand out for being those who rely on government funding as their principal source of revenue. Consolidation involves the combination of the accounts of these Crown corporations and other entities on a line-by-line and uniform basis of accounting and elimination of inter-organizational balances and transactions. Before these balances and transactions can be eliminated, the consolidated Crown corporations and other entities' accounts must be adjusted to the government's basis of accounting.

Therefore, a detailed breakdown of assets, liabilities, revenues and expenses, as well as information on accounting policy changes is required. This will facilitate the conversion of the consolidated Crown corporations and other entities' account balances and transactions to the government's accounting basis. This information is required for the preparation of the Government of Canada consolidated financial statements.

Other Crown corporations and reporting entities are able to raise substantial portions of their revenues through commercial business activities outside of the government reporting entity and are self-sustaining. These other Crown corporations and reporting entities are classified as either enterprise Crown corporations or other government business enterprises.

The investments in enterprise Crown corporations and other government business enterprises are recorded under the modified equity method of accounting whereby the corporations' accounts are not adjusted to the government's basis of accounting. Investments of this nature are recorded at cost and adjusted annually to recognize the investees' profits and losses, after elimination adjustments of unrealized inter-organizational gains or losses, and dividends received. Other comprehensive income or loss of enterprise Crown corporations and other government business enterprises is recorded directly to the government's accumulated deficit and net debt. The corporations' assets and liabilities are not included in these financial statements, except for borrowings which are not expected to be repaid directly by the corporations. These are recorded as part of the allowance for guarantees by the government.

Insurance programs operated by agent enterprise Crown corporations are disclosed in a note to the consolidated financial statements of the Government of Canada and relevant details are provided in Volume I: Summary Report and Consolidated Financial Statements.

Summary financial position and results of enterprise Crown corporations and other government business enterprises are also included in a note to the consolidated financial statements of the Government of Canada. Additional summary information is presented for all consolidated Crown corporations and other entities, as well as enterprise Crown corporations and other government business enterprises in Volume I of the Public Accounts of Canada. Therefore, submission of accurate, complete and timely information by all organizations that are part of the government reporting entity is essential to the timely preparation of the Public Accounts of Canada.

2.1 Authority

In order to fulfill the responsibilities in accordance with section 63 of the Financial Administration Act and section 64 of the Financial Administration Act, the Receiver General requests financial information on a quarterly basis.

2.2 Application

These instructions apply to the Crown corporations listed in schedule III of the Financial Administration Act, to other Crown corporations and other reporting entities listed in appendix A: List of Crown corporations and other reporting entities attached hereto, and to any other Crown corporation or other reporting entity coming into existence after March 31, 2024, which is controlled by the government; these are therefore part of the government reporting entity.

2.3 Instructions

Crown corporations and other reporting entities are required to report all account balances and transactions, contingent liabilities, contingent assets, contractual obligations, contractual rights, related party transactions and particulars of insurance programs and guarantee funds in accordance with the procedures and the timetable set forth in section 5. Reporting procedures of these instructions.

Enterprise Crown corporations and other government business enterprises reporting under International Financial Reporting Standards (IFRS) must report their financial information in the CC forms using the same accounting framework. Consolidated Crown corporations and other entities that have adopted IFRS must report their financial information in the CC forms based upon Public Sector Accounting Standards (PSAS) for the values of balances and transactions for the year ended March 31, 2024 and subsequent quarters following the Government of Canada fiscal year (from April 1 to March 31). A quarterly reconciliation between IFRS and Canadian PSAS must be detailed in form CC-8: Reconciliation between IFRS and PSAS. The amount of the impact on the financial statements must be presented by financial statement item listed on the applicable CC form (assets, liabilities, equity, revenues, expenses and contingent liabilities). This requirement applies only to the following organizations:

- Canadian Air Transport Security Authority

- Canadian Broadcasting Corporation

- Canadian Commercial Corporation

- Canadian Dairy Commission

- Defence Construction (1951) Limited

- International Development Research Centre

- The Federal Bridge Corporation Limited

- Via Rail Canada Inc.

All other consolidated Crown corporations and other entities that have adopted PSAS as their basis of accounting must identify and describe any change in their accounting policies in form CC-7: Change in accounting policies or unusual transactions. These changes must also include any early PSAS adopted along with the amount of the impact on the financial statement components.

3. Responsibilities of the chief executive officer

The Chief Executive Officer of the Crown corporation or other entity is responsible for:

- ensuring that the financial data is prepared in accordance with these instructions and is complete and accurate in all respects

- identifying insurance programs and guarantee funds including:

- determining amounts to be reported

- providing an assessment of the adequacy of the insurance fund or provision, using Office of the Superintendent of Financial Institutions Standards, wherever applicable

- providing information on factors or events that had or will have a material effect on the operation or financial position of the insurance fund or provision

- ensuring that the forms are submitted by the prescribed due date and accompanied by a signed copy of the transmittal memorandum (refer to subsection 5.12 Frequency of reporting)

- ensuring that a copy of the audited or interim financial statements or annual report is submitted as soon as available in accordance with subsection 5.11 Annual report

The chief executive officer may delegate the signing authority to the chief financial officer. Note that the certification of the information and the basis of accounting used in the preparation of CC forms are to be included on the transmittal memorandum.

4. Definitions related to these instructions

- Borrowings

- Contracts entered into for the use of money such as certificates of indebtedness (bonds), notes and loans payable.

- Consolidated Crown corporation

- A Crown corporation that relies on government funding as its principal source of revenue. Appendix A: List of Crown corporations and other reporting entities identifies these corporations by the indicator (C).

- Contingent asset

- Possible assets arising from existing conditions or situations involving uncertainty. That uncertainty will ultimately be resolved when one or more future events not wholly within the public sector entity's control occurs or fails to occur. Resolution of the uncertainty will confirm the existence or non-existence of an asset.

- Contingent liabilities

- Possible obligations that may result in the future sacrifice of economic benefits arising from existing conditions or situations involving uncertainty. That uncertainty will ultimately be resolved when one or more future events not wholly within the government's control occurs or fails to occur. Resolution of the uncertainty will confirm the incurrence or non-incurrence of a liability.

- Contractual obligations

- Obligations of a government to others that will become liabilities in the future when the terms of those contracts or agreements are met.

- Contractual rights

- A written right to receive future assets and revenue from outside organizations or individuals as a result of a contract or agreement.

Contractual rights result in revenues that are significant in relation to the usual operations of an entity. These contractual rights may govern the level of a certain type of revenue for a considerable period into the future. - Crown corporation

- A corporation which at March 31 falls within the definition of section 83 of the Financial Administration Act or section 85 of the Financial Administration Act. These include the corporations listed in parts I and II of schedule III of the Financial Administration Act as well as the following organizations:

- Bank of Canada

- Canada Council for the Arts

- Canadian Broadcasting Corporation

- Canadian Race Relations Foundation

- International Development Research Centre

- National Arts Centre Corporation

- Telefilm Canada

- Enterprise Crown corporation

- A Crown corporation that is able to raise substantial portions of its revenues through commercial business activities outside of the government reporting entity and which is self-sustaining. Appendix A: List of Crown corporations and other reporting entities identifies these corporations by the indicator (E).

- Government of Canada (government)

- As a reporting entity, the Government of Canada comprises all organizations that are controlled by the government.

- Government organization

- An organization including a department, an agency and any other organization that is part of the Government of Canada reporting entity. Refer to the complete list in appendix B: List of government organizations—Departments and agencies (by ministry and in alphabetical order).

- Insurance program or guarantee fund

- A program where the insured, an outside party (not employees), pays an insurance fee which is credited to an insurance fund or guarantee fund or provision operated or maintained by an enterprise Crown corporation. The amount of the fee is based on the estimated amount of insurance fund or provision needed to meet future claims and administrative expenses. Insurance programs such as employee group insurance, dental plans, etc., are not included in this definition.

- Key management personnel

- Are those individuals having authority and responsibility for planning, directing and controlling the activities of the Government of Canada.

For the Government of Canada reporting entity (consolidated financial statements), key management personnel are defined as:- ministers and deputy head

- heads of Crown corporation

- Other consolidated entities

- Other reporting entities, as defined below, who rely on government funding as their principal source of revenue. Appendix A: List of Crown corporations and other reporting entities identifies these other entities by the indicator (C).

- Other reporting entities

- Organizations not listed in the FAA meeting the definition of control for financial reporting purposes. These organizations are included in the government reporting entity if their revenues, expenses, assets, or liabilities are significant.

- Other government business enterprise

- A corporation that is not considered a Crown corporation within the meaning of the FAA, but which is controlled by the government and in most cases accountable to Parliament through a minister of the Crown for the conduct of its affairs. It is able to raise substantial portions of its revenues through commercial business activities outside of the government reporting entity and is self-sustaining. Appendix A: List of Crown corporations and other reporting entities identifies these other government business enterprises by the indicator (E).

- Related party

- A related party exists when one party has the ability to exercise control or shared control over the other. Two or more parties are related when they are subject to common control or shared control. Related parties also include key management personnel and close family members. Close family members include an individual's spouse and those dependent on either the individual or the individual's spouse.

Transactions with entities controlled by, or under shared control of, a member of key management personnel or a close family member of that individual is also considered a transaction with key management personnel. - Wholly-owned subsidiary

- A corporation that is wholly-owned by one or more parent Crown corporations directly or indirectly through any number of subsidiaries each of which is wholly-owned directly or indirectly by one or more parent Crown corporations.

5. Reporting procedures

This section contains general guidelines applicable to most of the CC forms, followed by specific instructions for the submission of particular CC forms.

To prepare the required documents for submission, please follow the steps below:

- round all amounts to the nearest thousand dollars (ensure that no decimals are input in the CC forms as they cause rounding issues during the consolidation process)

- individually report balances and transactions of $100,000 and above under each category/heading except where specifically mentioned otherwise (when filling out the CC forms, do not overwrite the cells that contain pre-populated formulas)

- if a cell in a CC form is not applicable or the value is nil, write "N/A" or insert the number "0" to indicate that the requested information has not been overlooked

- if corrections are made following discussions with the Office of the Comptroller General (OCG) or the Receiver General, update and highlight all changes in the CC forms and forward the documents with a summary of the changes to the Receiver General as soon as possible

Report the outstanding balances at the end of each quarter as well as revenue and expense results on a cumulative basis from April 1 to the end of each quarter for some items listed under the following sections:

- 5.1 Assets, liabilities and equity

- 5.2 Revenues, expenses and other comprehensive income

- 5.3 Equity accounts

- 5.4 Annual supplementary information on capital assets and assets under capital leases (report transactions from April 1 to March 31, and balances as at March 31)

- 5.5 Supplementary information on borrowings, contingent liabilities, contingent assets, contractual obligations and contractual rights

- 5.6 Change in accounting policies or unusual transactions

- 5.7 Reconciliation between International Financial Reporting Standards and Public Sector Accounting Standards

- 5.8 Related party transactions

- 5.9 Insurance programs

Report separately balances and transactions with government organizations or Crown corporations and other reporting entities on the following forms:

- forms CC-1, CC-1a, CC-2 and CC-2a for statement of financial position items

form CC-3 for revenue and expense items, even though they may have been netted against another item in the financial statements of the entity

form CC-3 for revenue and expense items, even though they may have been netted against another item in the financial statements of the entity

Similarly, include in forms CC-4, CC-4a and CC-4b items affecting:

- contributed surplus

- accumulated profits or losses

- net assets or liabilities

- capital stock

- other equity accounts or funds

- accumulated other comprehensive income or losses

- accumulated remeasurement gains or losses

Crown corporations and other reporting entities created during the fiscal year are to be considered part of the list appearing in appendix A: List of Crown corporations and other reporting entities or form CC-12. This also applies to wholly-owned subsidiaries that will be presented in the Public Accounts.

If a Crown corporation or another entity is sold or privatized, that entity will be deemed to be excluded from the list of appendix A: List of Crown corporations and other reporting entities or form CC-12 in the year after the sale or the privatization is finalized.

When shares of a Crown corporation are offered to parties outside the government, thus reducing the government's ownership to less than 100%, the Crown corporation is no longer wholly-owned and, therefore, loses its status of Crown corporation. In the event that the organization continues to be controlled by the Government of Canada, forms will still be required. If control is not maintained, the investment in the organization will be recorded at cost and the organization will be reclassified as a portfolio investment.

The following transactions and balances must be itemized to aid in the reconciliation of transactions between the Government of Canada and each Crown corporation or other reporting entity and among Crown corporations or other reporting entities themselves:

- amounts receivable from the Government of Canada, consolidated Crown corporations and other entities and enterprise Crown corporations and other government business enterprises:

- these amounts include trade receivables and amounts receivable under parliamentary appropriations

- details must also be provided for any holding of government-issued debt and any balance of unamortized premiums or discounts relating to these instruments

- liabilities payable to the Government of Canada, consolidated Crown corporations and other entities and enterprise Crown corporations and other government business enterprises:

- these amounts include trade payables

- the schedule of deferred capital funding must be completed to identify the portion of appropriations for depreciable capital assets, the amortization or any other necessary adjustment

- the maturity of borrowings from the Government of Canada for future fiscal years including accrued interest

- revenues and expenses with the Government of Canada or other Crown corporations and other reporting entities:

- these include revenues generated from the following activities:

- operations

- operating or capital appropriations

- investments

- grants or subsidies

- gains on disposals of capital assets

- foreign exchange gain

- amortization of deferred capital funding

- unrealized gains on fair value adjustments

- other types of income

- expenses are to be itemized as follows:

- personnel (excluding pensions and other employee future benefits)

- transportation and communications

- information

- professional and special services

- rentals

- repairs and maintenance

- utilities, materials and supplies

- pensions and other employee future benefits

- grants or subsidies

- finance charges

- interest on capital leases

- interest on borrowings

- interest related to P3

- amortization of capital assets

- losses on disposals of capital assets

- foreign exchange losses

- unrealized losses on fair value adjustment

- other types of expenses

- these include revenues generated from the following activities:

Please refer to form CC-12 for a list of Crown corporations and other reporting entities while completing the CC forms. Entities not listed on this form are considered third parties.

The St. Lawrence Seaway Management Corporation reports on 2 or more divisions or sets of operations, funds or programs and/or special accounts in its audited financial statements. In order to properly compile data from the entity, more detail is required to identify the separate divisions, funds or programs or special accounts that are part of it. Consequently, a complete set of forms CC-1 to CC-8 and CC-10 is required from the following account or fund:

- corporate account

- capital fund trust

- employee termination benefits trust fund

Consolidated Crown corporations which consolidate their financial results on a line-by-line basis into the Public Accounts of Canada need to ensure they are in compliance with the following new Public Sector Accounting Standards:

Consolidated Crown corporations which consolidate their financial results on a line-by-line basis into the Public Accounts of Canada need to ensure they are in compliance with the following new Public Sector Accounting Standards:

- Revenue (PS 3400)

- Public Private Partnerships (PS 3160)

- Purchased Intangibles (PSG-8)

5.1 Assets, liabilities and equity

This section provides instructions related to forms CC-1, CC-1a, CC-1b, CC-1c and CC-1d (assets) and forms CC-2, CC-2a, CC-2b-1, CC-2b-2, CC-2b-3, CC-2b-4, CC-2b-5, CC-2c, CC-2d, CC-2d-1, CC-2d-2, CC-2d-3, CC-2e and CC-2f (liabilities and equity).

An image capture of form CC-1 is provided below as an example:

Format available for download: JPG: Form CC-1: Assets

An image capture of form CC-1a is provided below as an example:

Format available for download: JPG: Form CC-1a: Assets—Supporting details

An image capture of form CC-1b is provided below as an example:

Format available for download: JPG: Form CC-1b: Assets—Supporting details

An image capture of form CC-1c is provided below as an example:

Format available for download: JPG: Form CC-1c: Assets—Supporting details

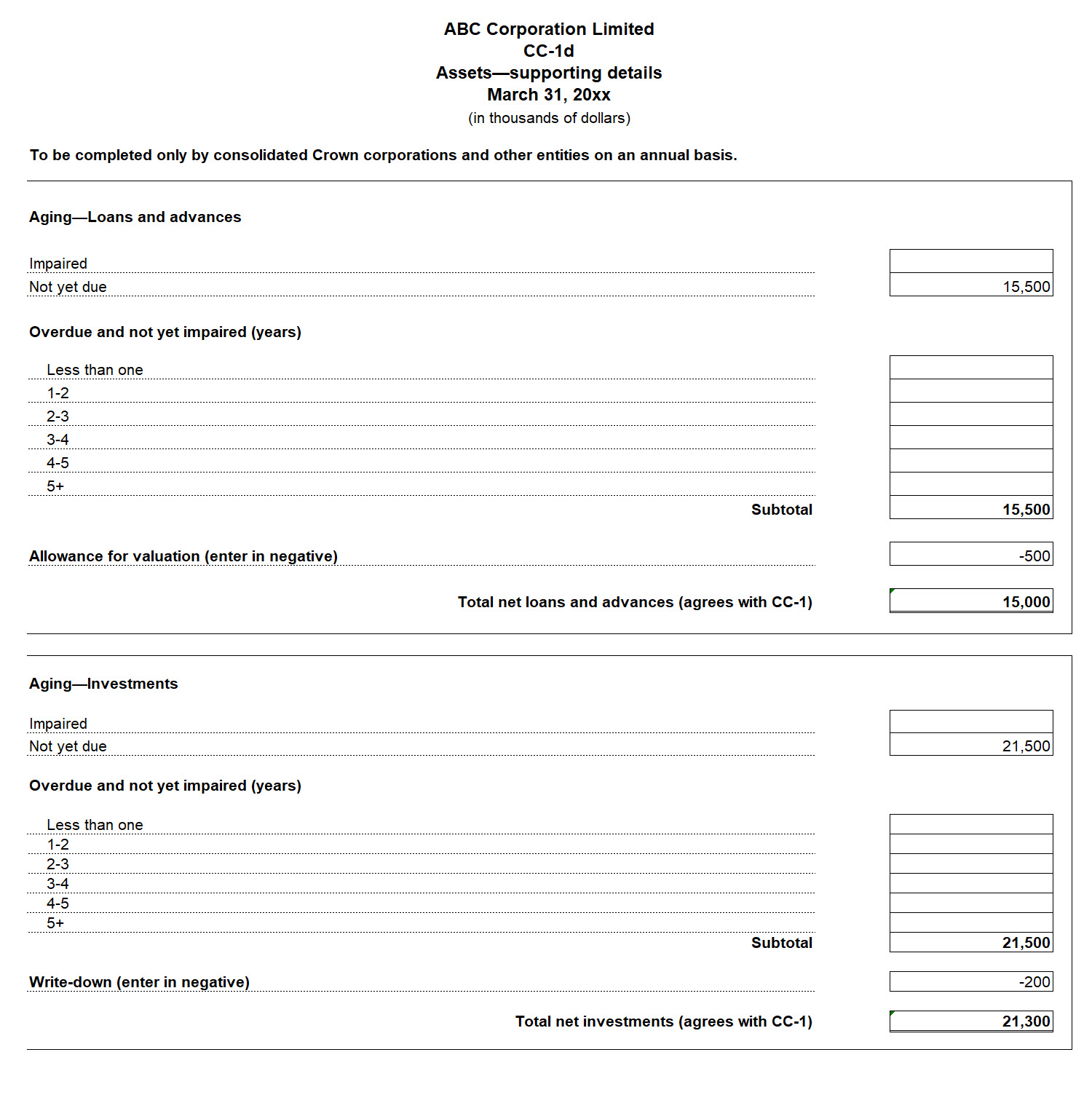

An image capture of form CC-1d is provided below as an example:

Format available for download: JPG: Form CC-1d: Assets—Supporting details

An image capture of form CC-2 is provided below as an example:

Format available for download: JPG: Form CC-2: Liabilities and equity

An image capture of form CC-2a is provided below as an example:

Format available for download: JPG: Form CC-2a: Liabilities—Supporting details

An image capture of form CC-2b-1 is provided below as an example:

Format available for download: JPG: Form CC-2b-1: Liabilities—Supporting details

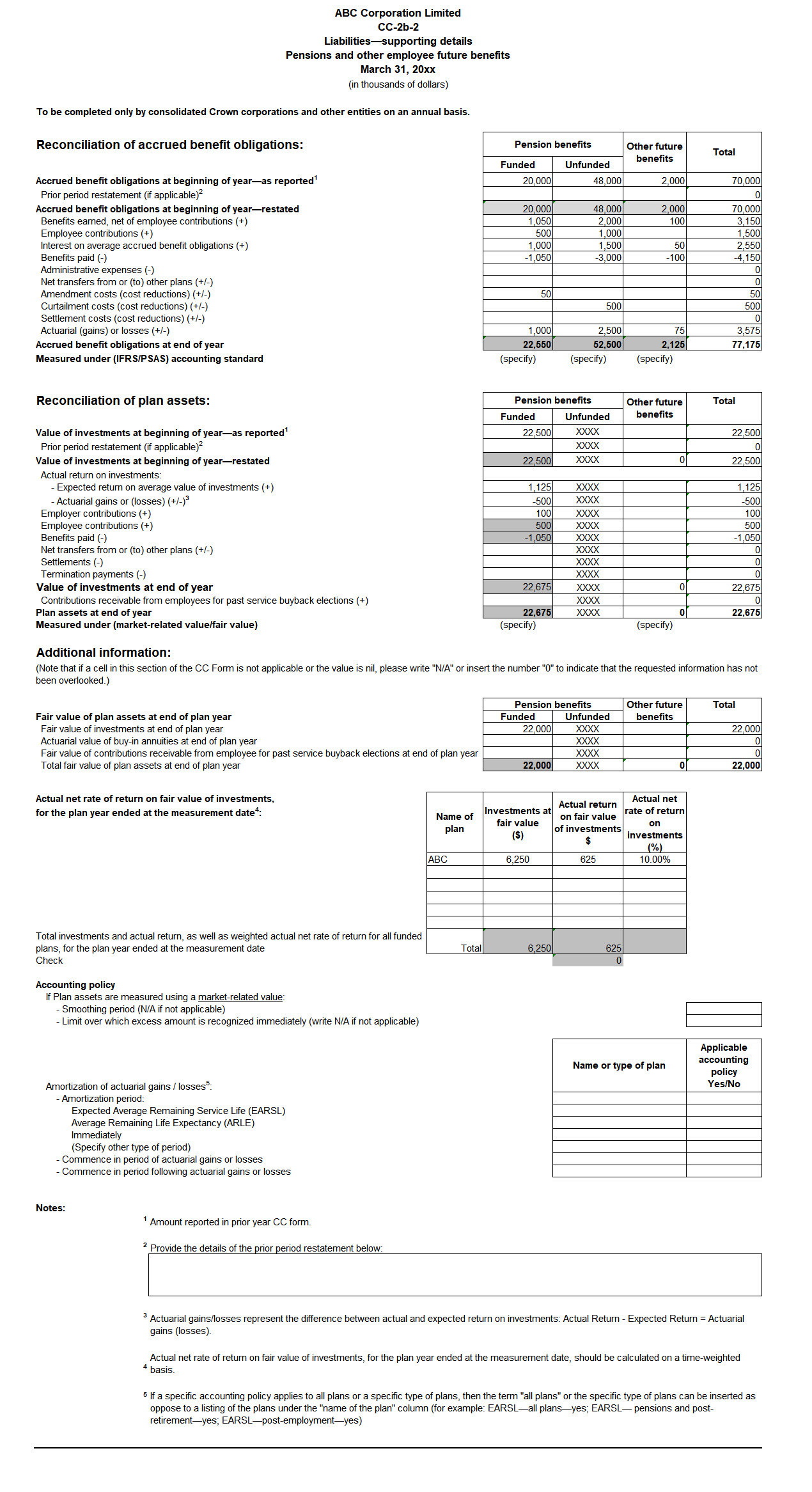

An image capture of form CC-2b-2 is provided below as an example:

Format available for download: JPG: Form CC-2b-2: Liabilities—Supporting details

An image capture of form CC-2b-3 is provided below as an example:

Format available for download: JPG: Form CC-2b-3: Liabilities—Supporting details

An image capture of form CC-2b-4 is provided below as an example:

Format available for download: JPG: Form CC-2b-4: Liabilities—Supporting details

An image capture of form CC-2b-5 is provided below as an example:

Format available for download: JPG: Form CC-2b-5: Liabilities—Supporting details

An image capture of form CC-2c is provided below as an example:

Format available for download: JPG: Form CC-2c: Liabilities—Supporting details

An image capture of form CC-2d is provided below as an example:

Format available for download: JPG: Form CC-2d: Liabilities—Supporting details

An image capture of form CC-2d-1 is provided below as an example:

Format available for download: JPG: Form CC-2d-1: Liabilities—Supporting details

An image capture of form CC-2d-2 is provided below as an example:

Format available for download: JPG: Form CC-2d-2: Liabilities—Supporting details

An image capture of form CC-2d-3 is provided below as an example:

Format available for download: JPG: Form CC-2d-3: Liabilities—Supporting details

An image capture of form CC-2e is provided below as an example:

Format available for download: JPG: Form CC-2e: Liabilities—Supporting details

An image capture of form CC-2f is provided below as an example:

Format available for download: JPG: Form CC-2f: Liabilities—Supporting details

Forms CC-1 and CC-2 are designed to distinguish between financial and non-financial assets, liabilities and equity accounts. Assets and liabilities are in turn segregated between:

- third parties

- the Government of Canada

- enterprise Crown corporations and other government business enterprises

- consolidated Crown corporations and other entities

The financial position items listed on the forms are those most commonly used.

Identify separately under "Other", with an appropriate description, all financial position items not specifically listed on the forms.

Forms CC-1a and CC-2a are required to facilitate the reconciliation of trade receivables or payables, appropriations receivable or payable between the Government of Canada and each Crown corporation and other reporting entity and among Crown corporations and other reporting entities.

Identify individual balances of $1 million or more and group together balances of less than $1 million to make up the total reported in forms CC-1 and CC-2. Provide this supporting detail for March 31, preliminary and final submissions.

For investments with the Government of Canada and Crown corporations and other reporting entities reported in form CC-1:

- provide details of any unamortized discounts or premiums or fair value gains or losses of these financial assets in form CC-1a

- the specification of the investment certificate (for example, Marketable bonds, Treasury bills, etc.) as well as the certificate series, maturity date and financial instrument measurement category are required for adjustments in the Public Accounts of Canada

- when applicable, provide details in form CC-1a for March 31, preliminary and final submissions

- when applicable, consolidated Crown corporations and other entities are required to complete the supporting details schedule in form CC-1c for March 31 preliminary and final submissions, regarding:

- trade accounts receivable with third parties

- other receivables

- accrued interest, fees, etc.

- trade accounts receivable with enterprise Crown corporations and other government business enterprises

when applicable, consolidated Crown corporations and other entities are required to complete the supporting details schedule in form CC-1d for March 31 preliminary and final submissions, regarding:

when applicable, consolidated Crown corporations and other entities are required to complete the supporting details schedule in form CC-1d for March 31 preliminary and final submissions, regarding:

- Loans and advances

- Investments

Borrowings from third parties reported in form CC-2 must include accrued interest. The end of period balance should agree with the corresponding amounts reported in form CC-6.

Borrowings and notes payable from the Government of Canada reported in form CC-2 must include accrued interest. The end of period balance should agree with the corresponding amounts reported in form CC-2e.

When applicable, complete the schedule for "deferred capital funding" in form CC-2a for March 31, preliminary and final submissions.

You should report as other liabilities, with the appropriate description, any equity that by statute is to be used for the benefit of a certain group of third parties.

Report the financial instruments information in forms CC-1b and CC-2c. These forms are designed to gather information on financial instruments even when they are also presented elsewhere in the entity's forms submission. The forms require the Government of Canada values based upon PSAS, the fair values and general ledger values. However, only consolidated Crown corporations and other entities must report the Government of Canada values based upon PSAS.

Report on financial instruments including information regarding the classification and measurement category of financial assets and financial liabilities such as:

- amortized cost

- fair value through other comprehensive income

- fair value through profit or loss

Report the financial position item "Environmental liabilities" in form CC-2.

Consolidated Crown corporations and other entities must also complete form CC-2d which is designed to provide more detailed information regarding "remediation liabilities for contaminated sites" and "asset retirement obligations".

Consolidated Crown corporations and other entities that are disclosing contingent liabilities, measurement uncertainty related to contaminated sites or have sites suspected of contamination for which they have not recognized a liability must also complete form CC-2d-1.

Consolidated Crown corporations and other entities that are not recording their contaminated sites in the Federal Contaminated Sites Inventory (FCSI) must also complete form CC-2d-2.

Form CC-2d: Supporting details

Disclose information either in Table 1 or Table 2 as described below:

Table 1: Remediation liabilities for contaminated sites

In accordance with PS 3260, all consolidated Crown corporations and other entities must recognize a remediation liability when all recognition criteria are met (PS 3260.08). In addition, disclose the following elements:

- nature and source of liability

- basis of the estimate

- estimated total discounted and undiscounted amount of the liability and discount rate (when you use the net present value)

- reasons why a liability is not recognized for sites suspected of contamination

- estimate of the amount of expected recoveries per the standard PS 3260.65

Include this information in forms CC-2d and CC-2d-1.

The Government of Canada has currently established a list of 10 categories for nature and source of liability (or contaminant). The categories are included in form CC-2d. Report the remediation liability under the appropriate category.

If recoveries are expected, identify their closing balance separately. The recoveries should be recorded in the assets as other accounts receivable.

Closing liability balances should be discounted using a net present value technique if cash flows required to settle the liability are expected to occur over extended future periods. Report the undiscounted amount of the liability. You should also adjust the undiscounted liabilities for inflation (CPI—Consumer Price Index).

In addition, answer the 8 questions in form CC-2d in order to meet the disclosure requirements.

Table 2: Asset retirement obligations

Consolidated Crown corporations and other entities that have reported asset retirement obligations must provide a detailed breakdown of that category including:

- applicable discount rates and basis

- estimated number of years to resolve the obligation

- inflation rate applied

- corresponding amount for each item presented

- reasons why a liability is not recognized for suspected assets of having a retirement obligation

- estimate of the amount of expected recoveries per the standard PS 3280.62

Form CC-2d is only required for March 31, preliminary and final submissions.

The Government of Canada has currently established a list of 14 categories for nature and source of liability. The categories are included in form CC-2d. Report the ARO liability under the appropriate category.

If recoveries are expected, identify their closing balance separately. The recoveries should be recorded in the assets as other accounts receivable.

Closing liability balances should be discounted using a net present value technique if cash flows required to settle the liability are expected to occur over extended future periods. Report the undiscounted amount of the liability. You should also adjust the undiscounted liabilities for inflation (CPI—Consumer Price Index).

In addition, answer the 8 questions in form CC-2d in order to meet the disclosure requirements.

Form CC-2d-1 and CC-2d-3: Supporting details

Disclose information on Remediation liabilities for contaminated sites (form CC-2d-1) and Liabilities for asset retirement obligations (for CC-2d-3) as indicated below.

The details of all sites or asset retirement obligations disclosing a contingent liability, measurement uncertainty and also sites suspected of contamination where liabilities were not recorded should be reported.

For sites or asset retirement obligations disclosing a contingent liability, provide the following information:

- FCSI site number, site name, or asset name

- amount disclosed

- nature and source of the liability

- reason for not recognizing a liability

Note that the only reason to disclose a contingent liability is due to uncertainty related to responsibility that is currently undeterminable. Inability to estimate the cost does not constitute a contingent liability. Report the estimate of the contingent liability associated with the costs for remediation in form CC-2d-1 and those relating to asset retirement obligation in form CC-2d-3.

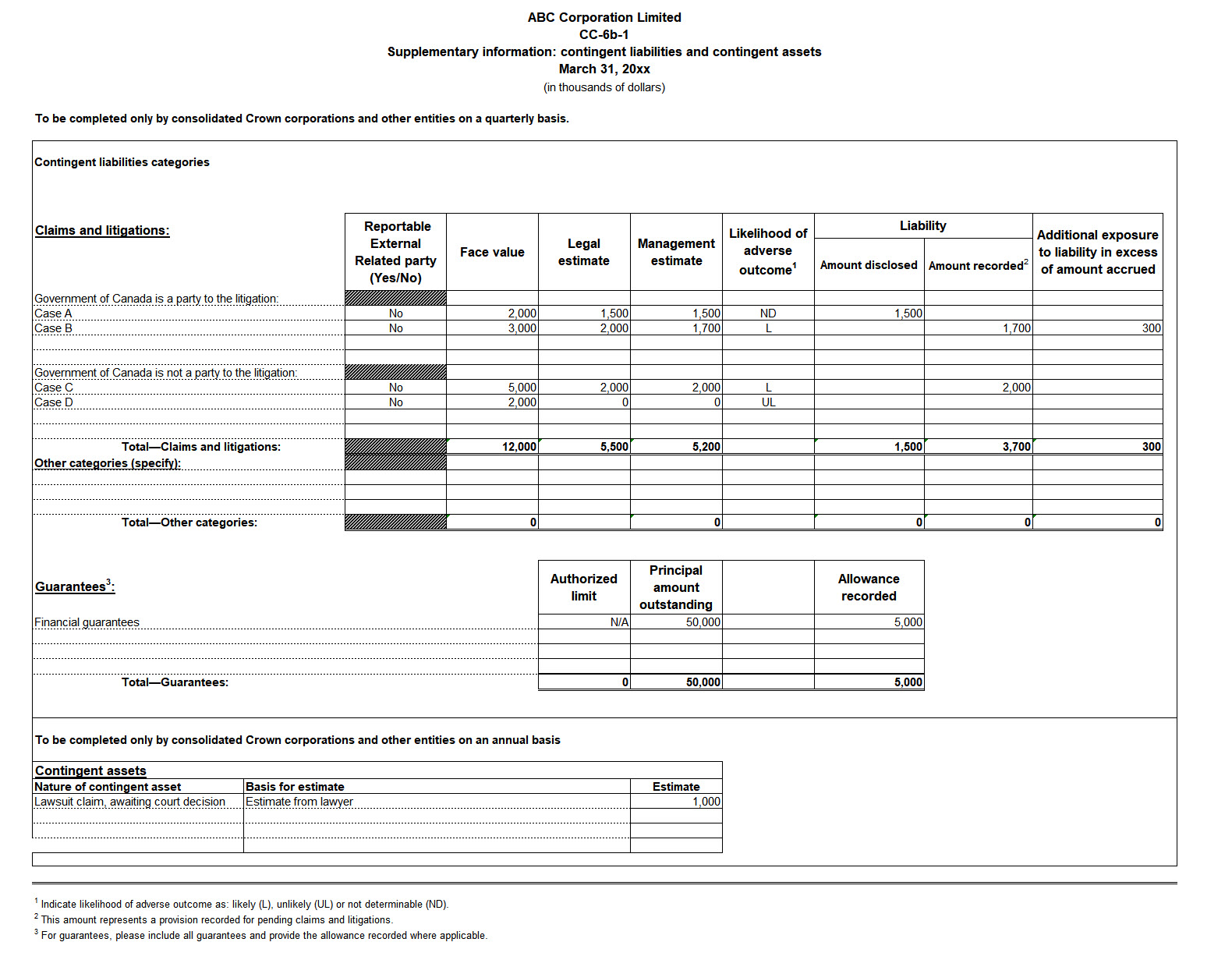

Note also that if a contaminated site or asset retirement obligation is involved in litigation, the estimate of the contingent liability associated with the damages should be reported on the following forms:

- form CC-6a for enterprise Crown corporations and other government business enterprises

- form CC-6b-1 for consolidated Crown corporations and other entities

Do not report the estimate for damages in forms CC-2d-1 and CC-2d-3.

Measurement uncertainty disclosure should be reported. For sites disclosing measurement uncertainty, as per PS 2130, you should provide the following information:

- FCSI site number, site name or asset name

- amount currently recognized as a liability

- nature and source of liability

- both the lowest and highest estimates

- reason for measurement uncertainty

You must also respond to the 2 questions on the form and specify if you expect to change the amount within the year and if this amount will be considered material.

Liabilities that have not been recognized on sites suspected of contamination or asset retirement obligations must be reported. Include and respond to the following elements:

- name of the site or asset name

- location

- reason for not recognizing a liability

- explanation for the reason

- action plan to address the situation

Form CC-2d-2: Supporting details, environmental liabilities—Remediation liabilities

All consolidated Crown corporations and other entities that are recording or disclosing liabilities for contaminated sites should be reporting this information in the FCSI. Consolidated Crown corporations and other entities that are NOT reporting sites in FCSI must complete form CC-2d-2 and identify all contaminated sites. Please contact Ashley Maloney 343‑548‑4644.

Form CC-2e: Supporting details, borrowings and notes payable from the Government of Canada

Enterprise Crown corporations and other government business enterprises are required to report additional information on the borrowings and notes payable from the Government of Canada. Form CC-2e requires details on any unamortized (discount) premium and any unrealized gains (losses) on borrowings or notes payable from the Government of Canada. This information is used to eliminate any unrealized inter-organizational gains and losses as required by the modified equity basis of accounting.

Form CC-2f: Supporting details, deferred revenues

When applicable, consolidated Crown corporations and other entities are required to complete the deferred revenues supporting details schedule in form CC-2f for March 31, preliminary and final submissions.

5.1.1 Liabilities: Supporting details, pensions and other employee future benefits

The following forms are applicable only to consolidated Crown corporations and other entities identified in appendix A: List of Crown corporations and other reporting entities:

- form CC-2b-1

- form CC-2b-2

- form CC-2b-3

- form CC-2b-4

- form CC-2b-5

These CC forms are designed to report information related to pensions and other employee future benefits and are used to prepare the Public Accounts of Canada.

In order to accurately report pensions and other employee future benefits in the Public Accounts of Canada, the information provided must be complete and accurate, in accordance with these instructions, and presented in the established format. The government and the consolidated Crown corporations and other entities may account for and present the information differently in their respective financial statements; therefore, some realignment or modification may be necessary to conform with the basis of accounting followed by the government and the presentation of the CC forms.

All CC forms in this section are mandatory. Complete them on an annual basis and include them in the report submitted to the Receiver General.

Because of materiality or depending on the individual circumstances of each organization, the Office of the Comptroller General (OCG) may request additional information or set other specific reporting requirements in order to ensure full compliance with PSAS. In these cases, the OCG will communicate directly with the specific Crown corporations or other entity and will notify the Receiver General as applicable. CC forms are designed so that only the combined totals for all funded pension plans, all unfunded pension plans and all other employee future benefits are reported.

Note

Funded plans refer to benefit plans for which plan assets are segregated and restricted in a trust or other legal entity separate from the reporting entity; these plans include benefit plans that are partially funded and, therefore, are in a deficit position.

Unfunded plans refer to benefit plans for which no plan assets are segregated and restricted in a trust or other legal entity separate from the reporting entity.

To ensure that all amounts or items are properly reported and classified, the use of the "Other" category should be kept to a minimum. If the “Other” category is used, provide an appropriate description based on the nature of the amount or item.

To facilitate the completion of the CC forms related to pensions and other employee future benefits, we recommend you complete the CC forms in the following order:

- form CC-2b-2: Reconciliations of accrued benefit obligations and plan assets

- form CC-2b-3: Expenses

- form CC-2b-1: Reconciliations of future benefit assets (liabilities), unamortized net actuarial (losses) gains, and valuation allowance

- form CC-2b-4: Supplementary information

- form CC-2b-5: Assumptions, actuarial valuations and sensitivity analysis

Consolidated Crown corporations and other entities that report under International Financial Reporting Standards

Some of the consolidated Crown corporations and other entities that report under IFRS and have funded defined pension plans are required, for the purpose of reporting in the CC forms, to remeasure annually their accrued pension obligations using expected rates of return on plan assets for discount rates as recommended in PSAS. This requirement applies only to the following organizations:

- Canadian Air Transport Security Authority

- Canadian Broadcasting Corporation

- Via Rail Canada Inc.

Re-measuring the unfunded defined benefit plans to conform to PSAS requirements is not mandatory at this point for the consolidated Crown corporations and other entities that report under IFRS.

However, all consolidated Crown corporations and other entities must complete the sensitivity analysis in form CC-2b-5. The sensitivity analysis will allow the OCG to assess, in particular, whether the impact of the difference between IFRS and PSAS discount rates is material.

Consolidated Crown corporations and other entities that report under Public Sector Accounting Standards

The government’s methodologies for selecting discount rates used in the measurement of its long-term assets and liabilities are outlined in the following document: Review of Methodologies to Determine Discount Rates. In this document, the government’s cost of borrowing is established by reference to the actual zero-coupon yield curve for Government of Canada bonds. Therefore, the government's unfunded employee future benefits are discounted using actual yields that reflect the timing of the expected future cash flows. Consolidated Crown corporations and other entities, that report under PSAS and have decided to determine their discount rates by reference to the government's cost of borrowing, should also define the government's cost of borrowing by reference to the actual zero-coupon yield curve for the Government of Canada bonds when measuring their unfunded employee future benefits in their financial statements.

Form CC-2b-1: Reconciliation of future benefit assets (liabilities)

Find more information on form CC-2b-1 below.

Part A—Future benefit assets (liabilities)

The purpose of Part A in form CC-2b-1 is to reconcile the accrued benefit obligation of the defined benefit plans to the amount presented in the statement of financial position as at March 31 (in forms CC-2 or CC-1). Enter amounts as follows:

- "Accrued benefit obligations at end of year":

- this amount is carried-over from form CC-2b-2

- calculated and entered as a negative value

- "Plan assets at end of year":

- this amount is carried-over from form CC-2b-2

- calculated and entered as a positive value

- "Unamortized net actuarial losses or (gains)":

- for Public Accounts purposes, all consolidated Crown corporations and other entities are required to account for and report actuarial gains and losses in accordance with PSAS

- therefore, consolidated Crown corporations and other entities must continue to defer and amortize these actuarial gains and losses over a reasonable future period, such as the expected average remaining service life (EARSL) of employees

- amortization may commence in the period following the determination of the actuarial gains/losses; in addition, accelerated amortization may occur following a plan amendment, curtailment or settlement

- the unamortized net actuarial gains (losses) represents the amount as at the consolidated Crown corporation or other entity's year-end

- enter the amount as a negative value for an unamortized net actuarial gains and as a positive value for an unamortized net actuarial losses

- for Public Accounts purposes, all consolidated Crown corporations and other entities are required to account for and report actuarial gains and losses in accordance with PSAS

- "Amounts after measurement date up to March 31":

- if the measurement date is other than March 31, the amount of employer contributions made to funded plans and benefits paid directly by the consolidated Crown corporation or other entity for unfunded plans between the measurement date and March 31 should be recorded in the reconciliation to arrive at the amount of future benefit assets (liabilities) at March 31

- "Valuation allowance":

- the valuation allowance represents the extent to which an accrued benefit asset is impaired when there is a plan surplus for accounting purposes that the consolidated Crown corporation or other entity is not entitled to benefit from fully

- the Chartered Professional Accountants of Canada Public Sector Handbook provides guidance on the limit of the carrying amount of an accrued benefit asset

- consolidated Crown corporations and other entities must record a valuation allowance for funded plans in accordance with PS 3250—Retirement Benefits

- note: Consolidated Crown corporations and other entities that are required to remeasure their accrued pension obligations under PSAS must ensure that they re-assess their valuation allowance under PSAS, as they may need to adjust or record an amount

- "Future benefit assets (liabilities), net of valuation allowance":

- ensure that the amounts of future benefit assets (liabilities), net of valuation allowance, as at March 31, equal the sum of the amounts presented on the Statement of assets (form CC-1) and the Statement of liabilities and equity (form CC-2)

- if these amounts do not equal the sum of the amounts in forms CC-1 and CC-2, explain the variances in the section "Other amounts not included in the above reconciliation"

- provide details of the nature and amount of the variances

- note: Even though the information on the funded pension plans is aggregated in the supporting CC forms, plans with future benefit assets are segregated from plans with future benefit liabilities

- they are presented accordingly in the financial statements (form CC-1 and form CC-2)

- therefore, future benefit assets for funded plans must not be netted against future benefit liabilities for funded and unfunded plans, but rather presented separately in form CC-1

- ensure that the amounts of future benefit assets (liabilities), net of valuation allowance, as at March 31, equal the sum of the amounts presented on the Statement of assets (form CC-1) and the Statement of liabilities and equity (form CC-2)

- "Additional Information":

- for the benefit plans that are in a deficit position (not fully funded plans and unfunded plans), provide the amount of the accrued benefit obligations and plan assets at March 31

Part B—Reconciliations and calculation checks

Part B of form CC-2b-1 aims to provide continuity schedules which help to reconcile the future benefit assets (liabilities), unamortized net actuarial gains (losses) and valuation allowance. If calculated amounts do not agree with those in Part A, provide details of the nature and amount of the variances.

The greyed-out cells are linked to other CC forms to ensure that proper amounts are included in the reconciliation. These cells should not be overridden. Only enter the information on the variances into the blank cells (for example, opening balance, stub period adjustment from prior year, one-time adjustment).

Form CC-2b-2: Reconciliations of accrued benefit obligations and plan assets

- "Reconciliation of accrued benefit obligations":

- based on the Crown corporation or other entity's measurement date

- consolidated Crown corporations and other entities that report under IFRS are required, for the purpose of reporting in the CC forms, to remeasure annually the accrued obligation of their funded defined pension plans using expected rates of return on plan assets for discount rates as recommended in PSAS

- this requirement applies only to the following entities:

- Canadian Air Transport Security Authority

- Canadian Broadcasting Corporation

- Via Rail Canada Inc.

- consolidated Crown corporations and other entities that report under PSAS and determine their discount rates by reference to the government's cost of borrowing, should apply the same discount rate setting methodology as the government to ensure consistency when using a present value technique

- the accrued benefit obligations at the beginning of the year should agree with the amount of accrued benefit obligations at the end of the year reported in the prior year's CC form

- if the opening balance has been restated, record the amount of restatement separately as "Prior period restatement"

- "Reconciliation of plan assets":

- this portion of the reconciliation pertains only to funded defined benefit plans

- unfunded defined benefit plans do not have plan assets; therefore, no amount of contributions and benefits paid should appear in the reconciliation

- this presentation may differ from the presentation used in the Crown corporation and other entity's financial statements, where benefits paid and matching amount of contributions may be recorded

- the reconciliation of the plan assets is based on the Crown corporation or other entity's measurement date

- plan assets at the beginning of the year should agree with the amount of plan assets at the end of the year reported in the prior year's CC form

- if the opening balance has been restated, record the amount of restatement separately as "Prior period restatement"

- actuarial gains or (losses) on plan assets represent the difference between the actual and the expected return on plan assets

- the expected return on plan assets and the actuarial gains or (losses) on plan assets must be disclosed separately

- special consideration should be given to this item as the presentation required in the CC form may vary from the presentation used in the Crown corporation and other entity's financial statements

- contributions receivable from employees for past service buyback elections are not included in investments but shown as a separate row item

- this portion of the reconciliation pertains only to funded defined benefit plans

- "Additional information":

- provide additional information as requested in this section

- note: The actual net rate of return on the fair value of investments must be based on the year ending at the Crown corporation or other entity’s measurement date

- as the actual net rate of return is calculated by funded pension plan, the total must represent the weighted actual net rate of return for all the funded pension plans

Form CC-2b-3: Expenses and contributions

Total expenses for the year comprise the benefit expense and net interest expense which should be reported separately in forms CC-2b-3 and CC-3: Statement of revenue and expenses:

- "Benefit expense":

- "Total benefit expense", as presented in the supporting schedule, is comprised of:

- defined benefit plan expense

- defined contribution plan expense

- contributions to public service pension plan (PSPP)

- expense regarding multi-employer plan accounted for as a defined contribution plan and contractual termination benefits, as applicable

- include employer contributions to the public service pension plan as a separate line item in the benefit expense

- "Total benefit expense", as presented in the supporting schedule, is comprised of:

- "Defined benefit plan expense":

- the amount related to each component of the defined benefit plan expense must be provided

- the employer's share of the cost of benefits earned (benefits earned less employee contributions) and the cost of plan amendments, curtailments and settlements should carry over from the reconciliation of the accrued benefit obligation (form CC-2b-2)

- when an accrued benefit asset is impaired, a valuation allowance or a change in valuation allowance should be recognized in the Statement of operations for the period in which the change occurs in accordance with PS 3250—Retirement Benefits

- the amortization of actuarial gains (losses) have to be accounted for in accordance with PSAS

- under PSAS, actuarial gains and losses must be amortized over a reasonable future period, such as EARSL

- amortization may commence in the period following the determination of the actuarial gains (losses)

- in addition, accelerated amortization may occur following a plan amendment, curtailment or settlement and the amount must be reported on a separate row

- "Contractual termination benefits":

- termination benefits include early retirement window enhancements, closure benefits and severance benefits relating to a reorganization or downsizing

- "Net interest expense":

- the amount of interest on the average accrued benefit obligations and the expected return on the average value of the investments should be carried-over from the reconciliation of the accrued benefit obligations and the reconciliation of the plan assets (form CC-2b-2), if applicable

- "Contributions made from April 1 to March 31":

- the amount of contributions made presented in the reconciliations may cover a 12-month period (the Crown corporation or other entity's disclosure period) that differs from the Government of Canada's reporting period (April 1 to March 31)

- similarly, any additional information on the amount of contributions made presented in the Crown corporation or other entity's annual report may cover a period that differs from the Government of Canada's reporting period

- therefore, please provide the amount of contributions made from April 1 to March 31

- in addition, present separately the employer regular contributions from employer special funding and solvency contributions

- note: Contributions are made by reference to plan terms and actuarial valuations

- however, in regards to unfunded defined pension plans, some Crown corporations and other entities report contributions equivalent to benefit payments in their own plan asset reconciliation

- these matching contributions must be excluded from the amount of contributions reported in form CC-2-b-3

- contributions to unfunded defined pension plans would normally be part of the Crown corporation and other entity's general funds

- the health care and dental plans for the government's retired employees are contributory plans, whereby contributions by retired plan members are made to obtain coverage

- if the Crown corporation or other entity has contributory future benefit plans, provide the amount of contributions made by retired plan members to obtain coverage from April 1 to March 31

- if there are no contributory future benefit plans, indicate "N/A" in the space provided

- present the costs and benefits paid net of these contributions in the reconciliations and supporting expense schedule

- the amount of contributions made presented in the reconciliations may cover a 12-month period (the Crown corporation or other entity's disclosure period) that differs from the Government of Canada's reporting period (April 1 to March 31)

Form CC-2b-4: Supplementary information

This section is used to provide an overview of all the future benefit plans accounted for by the Crown corporation or other entity as well as any changes to the plans that took place during the year:

- "Overview of benefit plans":

- provide the name of the future benefit plan and a brief overview of the plan for each of the categories indicated in the CC form

- for categories that do not apply, please indicate "does not apply" under the "Name of the plan" column

- you can take the overview of a plan from your most recent annual report or from another source

- insert additional rows as required

- confirm if the Crown corporation or other entity's pension plans are federally regulated private pension plans governed by the provision of the Pension Benefits Standards Act, 1985 and required to adhere to the directives of the Superintendent of Financial Institutions

- "Overview of entitlement to plans' surpluses for accounting purposes":

- for accounting purposes, provide a brief overview of the Crown corporation or other entity's entitlement to the funded pension plans' surpluses

- the overview should indicate if the Crown corporation or other entity is a sole or joint sponsor of the funded pension plans

- it should also specify if the Crown corporation or other entity is entitled to and how it can benefit fully from the funded pension plans' surpluses for accounting purposes

- for example, mention should be made of legally enforceable right to withdraw surplus assets, right to take a contribution holiday or right to receive a refund of contribution

- "Overview of financing arrangements":

- provide the name of the future benefit plan and a brief overview of the way it is financed

- for example, a plan could be financed from employee and employer contributions, as well as investment earnings, or retired plan members could contribute in order to obtain coverage

- the overview can be taken from the Crown corporation or other entity's most recent annual report or from another source

- insert additional rows as required

- for funded benefit plans, please indicate if funds are segregated and held in external trusts

- provide the name of the future benefit plan and a brief overview of the way it is financed

- "Overview of significant changes to the plans during the year":

- if you have reported plan amendment, curtailment or settlement in forms CC-2b-2 and CC-2b-3, you must provide:

- the name of the future benefit plan affected by the change

- a description of the change that occurred during the year

- additional rows (insert as required)

- if you have reported plan amendment, curtailment or settlement in forms CC-2b-2 and CC-2b-3, you must provide:

Form CC-2b-5: Assumptions, actuarial valuations and sensitivity analysis

- "Assumptions":

- present the rates used to determine the value of the accrued benefit obligations, as well as the benefit and interest expenses, in the format specified in the CC form

- for each of the benefit plans, indicate the name of the plan and the related amortization period

- insert additional rows as required

- "Actuarial valuations":

- for each of the benefit plans, indicate the date of the most recent valuation for funding purposes

- insert additional rows as required

- "Sensitivity analysis":

- all consolidated Crown corporations and other entities must report the sensitivity analysis in the number format specified in the CC form

- the sensitivity analysis will allow the OCG to assess whether the impact of the difference between IFRS and PSAS discount rates is material for consolidated Crown corporations and other entities that are not required to re-measure their defined benefit plans to conform to PSAS

5.2 Revenues, expenses and other comprehensive income

This section provides instructions related to form CC-3: Revenues and expenses and form CC-3c: Other comprehensive income.

This section provides instructions related to form CC-3: Revenues and expenses and form CC-3c: Other comprehensive income.

An image capture of form CC-3 is provided below as an example:

Format available for download: JPG: Form CC-3: Revenues and expenses

An image capture of form CC-3c is provided below as an example:

Format available for download: JPG: Form CC-3c: Other comprehensive income

Revenue and expense transactions, by category, on a cumulative basis from April 1 to the end of quarter reporting date

Identify revenues as to the source from which they are generated, such as:

- operations

- appropriations

- investments

- grants or subsidies

- gain on disposals of capital assets

- other

Expenses include the following categories:

- cost of sales and services

- cost of pension and other employee future benefits

- grants or subsidies

- finance charges

- interest on capital leases

- amortization of capital assets

- income taxes

- loss on disposals of capital assets

- other

The financial information is cumulative from April 1 of each year to the closing date of each quarter and includes the March 31 preliminary and final amounts to cover the period of 12 months.

When exact amounts are not available, estimates may be used.

For the various categories of revenues and expenses, identify revenue and expense amounts of transactions with:

- government organizations listed in appendix B: List of government organizations—Departments and agencies (by ministry and in alphabetical order)

- Crown corporations and other reporting entities listed in appendix A: List of Crown corporations and other reporting entities or in form CC-12

- third parties

Classify them in the appropriate column.

Note that amortization expenses fall under third parties.

Note

Classification between revenue and expense items in form CC-3 should be consistent with the presentation in the Crown corporation or other entity's own financial statements.

Enterprise Crown corporations and other government business enterprises reporting under IFRS in the CC forms must report net unrealized fair value adjustments on financial instruments at fair value through profit or loss separately in form CC-3 (even though it may have been netted against another item in the financial statements of the entity).

Ensure the amounts reported are properly classified between transactions with the Government of Canada, transactions with Crown corporations or other reporting entities and transactions with third parties to allow for reconciliation with form CC-1a.

Consolidated Crown corporations must ensure revenue reported on form CC-3 is disaggregated by source and type (primarily presenting a distinction between exchange and non-exchange transactions and a separate disclosure of revenues that are not related to recurring activities), in-line with PS 3400.

Consolidated Crown corporations must ensure revenue reported on form CC-3 is disaggregated by source and type (primarily presenting a distinction between exchange and non-exchange transactions and a separate disclosure of revenues that are not related to recurring activities), in-line with PS 3400.

Consolidated Crown corporations and other entities reporting under PSAS in the CC Forms must report net unrealized fair value adjustments on financial instruments in the fair value category in Remeasurement Gains and Losses (form CC-4b). Unrealized foreign exchange gains/losses should be recognized in this form or in remeasurement gains or losses (form CC-4b) in accordance with your accounting policy.

Only enterprise Crown corporations and other government business enterprises reporting under IFRS in the CC forms are required to report other comprehensive income (OCI) in form CC-3c. To allow for reconciliation with form CC-1a, ensure the amounts reported are properly described and classified between transactions with the Government of Canada, with Crown corporations or other reporting entities and with third parties.

Form CC-3c is not applicable to consolidated Crown corporations and other entities reporting under PSAS in the CC forms. These entities must ensure that the amounts reported in OCI in their own financial statements are properly presented on other CC forms in accordance with PSAS (in other words, actuarial gains and losses are deferred and amortized to benefit expense).

5.3 Equity accounts

This section provides instructions related to forms CC-4, CC-4a and CC-4b: Equity accounts.

An image capture of form CC-4 is provided below as an example:

Format available for download: JPG: Form CC-4: Equity accounts

An image capture of form CC-4a is provided below as an example:

Format available for download: JPG: Form CC-4a: Equity accounts

An image capture of form CC-4b is provided below as an example:

Format available for download: JPG: Form CC-4b: Equity accounts

These forms are designed to report equity transactions segregated between the Government of Canada, Crown corporations and other reporting entities, and third parties.

- "Contributed surplus":

- identify transactions by source as related to the Government of Canada, Crown corporations and other reporting entities, or third parties for the following transaction types:

- receipt of additional capital

- special appropriations

- donations

- unusual write-offs

- identify transactions by source as related to the Government of Canada, Crown corporations and other reporting entities, or third parties for the following transaction types:

- "Accumulated profits / losses or net assets / liabilities":

- the opening balance must agree to the closing balance reported in the prior year

- present separately any prior period restatements and provide sufficient explanation for the restatement

- identify transactions by source as related to the Government of Canada, Crown corporations and other reporting entities, or third parties for the following transactions types:

- dividends declared to the government (in other words, declared or paid by the corporation to the government)

- transfers of excess funds or profits

- provisions, allowances

- special or unusual write-offs

- properly describe and provide appropriate explanations for prior year adjustments

- consolidated Crown corporations and other entities reporting under PSAS in the CC forms must exclude remeasurement gains or losses (if applicable) from the Statement of net assets or liabilities and report them on the Statement of accumulated remeasurement gains or losses (form CC-4b)

- any change in accounting policy resulting in a restatement must be substantiated by completing form CC-7 and must reflect a description of the change and the quantitative impact on the financial statement items

- enterprise Crown corporations and other government business enterprises reporting under IFRS in the CC forms must report the total of non-reclassifying OCI for the year in this form

- "Capital stock":

- identify transactions related to capital stock such as new issues or restructuring in form CC-4a

- "Other equity accounts or funds":

- provide the name of other equity accounts or funds

- note that reserves are included in this category

- you must identify transactions related to this type of equity account or fund and explain the nature of the changes in form CC-4a

- "Accumulated other comprehensive income or losses":

- form CC-4b is designed to gather information related to the accumulated other comprehensive income or losses of enterprise Crown corporations and other government business enterprises

- on this form, enterprise Crown corporations and other government business enterprises must report the total of reclassifying OCI for the year and the amounts reclassified to profit or loss during the year

- "Accumulated remeasurement gains or losses":

- form CC-4b is designed to gather information related to accumulated remeasurement gains or losses of consolidated Crown corporations and other entities

- the amounts reported in the accumulated remeasurement gains or losses generally arise from:

- unrealized gains and losses attributable to financial instruments in the "Fair value" category such as:

- derivatives

- portfolio investments in equity instruments that are quoted in an active market

- financial instruments elected to be measured at fair value

- unrealized exchange gains and losses in a foreign currency if election is made to be recognized in the statement of remeasurement gains and losses

- unrealized gains and losses attributable to financial instruments in the "Fair value" category such as:

- some entities have several equity account categories (use forms CC-4 and CC-4a to detail any changes in such equity accounts or funds)

- the above financial information is cumulative from April 1 to the closing date of each quarter

- March preliminary and final amounts represent 12 months of financial information

- note that the end of period balance of the equity accounts must agree with the corresponding equity accounts reported in form CC-2

- "Accumulated actuarial gains or losses":

- form CC-4b includes a table to gather information related to accumulated actuarial gains or losses of enterprise Crown corporations and other government business enterprises on defined benefit plans

- PSAS requires that accumulated actuarial gains or losses of enterprise Crown corporations and other government business enterprises be disclosed in the Statement of Remeasurement Gains and Losses (as opposed to being recognized directly into retained operating deficit

5.4 Annual supplementary information on capital assets, assets under capital leases and public private partnerships

5.4 Annual supplementary information on capital assets, assets under capital leases and public private partnerships

This section provides instructions related to forms CC-5, CC-5a, CC-5b, CC-5c and CC-5d: Annual supplementary information.

An image capture of form CC-5 is provided below as an example:

Format available for download: JPG: Form CC-5: Capital assets schedule

An image capture of form CC-5a is provided below as an example:

Format available for download: JPG: Form CC-5a: Assets and obligations under capital leases

An image capture of form CC-5b is provided below as an example:

Format available for download: JPG: Form CC-5b: Supplementary information on capital assets

An image capture of form CC-5c is provided below as an example:

Format available for download: JPG: Form CC-5c: Amortization policies, works of art or unrecognized assets

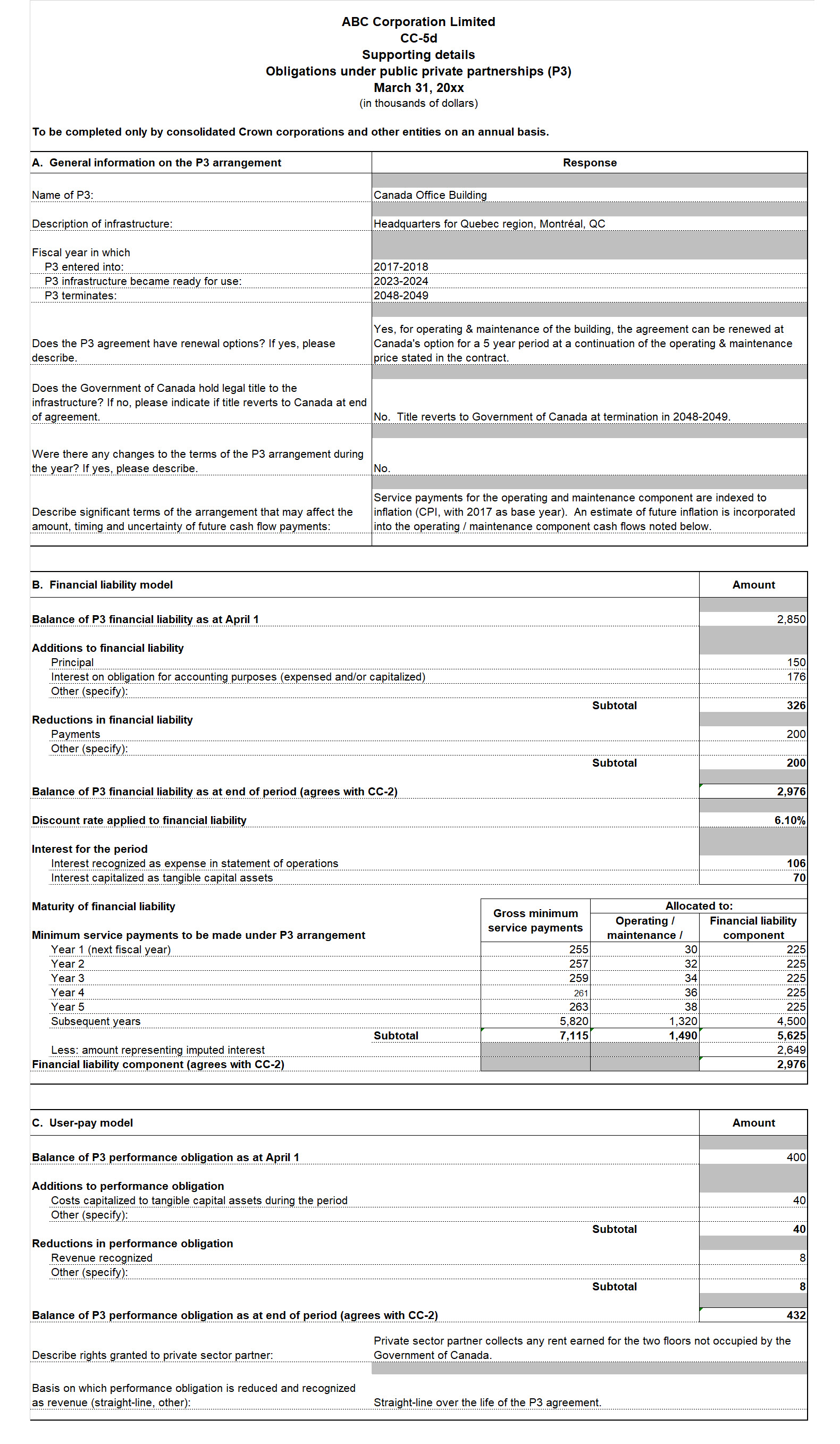

An image capture of form CC-5d is provided below as an example:

Format available for download: JPG: Form CC-5d: Supporting details—Obligations under public private partnerships (P3)

These forms are designed to report transactions or information related to:

- capital assets

- assets under capital leases

- obligations related to capital leases

- amortization policies

- information on works of art or unrecognized assets

- obligations under P3

- other supplementary information

5.4.1 Details of transactions relating to capital assets

The schedule provides details of capital assets and amortization thereof covering the 12 month period ending March 31 of the current year.

Enter amounts as follows:

- "Categories of capital assets":

- report capital assets under the main categories of tangible capital assets, and work in progress on tangible capital assets

- "Opening balance April 1":

- report the opening balance as at April 1 (it is the closing balance as at March 31 of the previous period)

- "Acquisitions during the year":

- report the cost of capital assets acquired during the 12 month period ending March 31

- "Sales / Disposals":

- report the elimination of the original cost of the capital assets sold, traded in or disposed during the 12 month period ending March 31

- report the elimination of the accumulated amortization related to capital assets that have been sold, traded in or disposed of during the period

- "Write-offs":

- report the elimination of the original cost of the capital assets written-off during the 12 month period ending March 31

- report the elimination of the accumulated amortization related to capital assets that have been written-off during the period

- "Work in progress transfers":

- work in progress transfers to capital assets categories are reported in this column by reporting a reduction in the work in progress account and an increase in the appropriate capital asset category

- the total impact of this transfer should be nil

- "Other transactions":

- represent any adjustments made to capital assets or accumulated amortization except acquisitions, sales, disposals, write-offs and trade-ins

- for other transactions over $1 million, provide a detailed description of the adjustment

- "Amortization for the year":

- the amortization for the year represents the charge made to reflect the economic usage of the assets during the 12 month period ending March 31

- "Closing balance March 31":

- represents the original cost of the asset still owned by the entity (capital assets) or the total accumulated amortization related to the closing balance of the capital assets

- "Net book value balance at March 31":

- ensure that the net amount agrees with that reported on the financial position item in form CC-1 as of March 31 of the current period

- "Proceeds on disposition of capital assets during the year ending March 31":

- amounts received for capital assets sold or as a trade-in allowance, as shown in total on a separate row

5.4.2 Details of transactions relating to assets under capital leases

The following information is required:

- "Categories of assets under capital leases":

- report assets under capital leases for the main categories of leased capital assets

- "Opening balance April 1":

- report the opening balance as at April 1 (it is the amount reported as the closing balance as at March 31 of the previous period)

- "Acquisitions during the year":